34. Cass-Koopmans Model#

34.1. Overview#

This lecture and Cass-Koopmans Competitive Equilibrium describe a model that Tjalling Koopmans [Koopmans, 1965] and David Cass [Cass, 1965] used to analyze optimal growth.

The model extends the model of Robert Solow described in an earlier lecture.

It does so by making saving rate be a decision, instead of a hard-wired constant.

(Solow assumed a constant saving rate determined outside the model.)

We describe two versions of the model, a planning problem in this lecture, and a competitive equilibrium in this lecture Cass-Koopmans Competitive Equilibrium.

Together, the two lectures illustrate what is, in fact, a more general connection between a planned economy and a decentralized economy organized as a competitive equilibrium.

This lecture is devoted to the planned economy version.

In the planned economy, there are

no prices

no budget constraints

Instead there is a dictator that tells people

what to produce

what to invest in physical capital

who is to consume what and when

The lecture uses important ideas including

A min-max problem for solving a planning problem.

A shooting algorithm for solving difference equations subject to initial and terminal conditions.

A turnpike property of optimal paths for long but finite-horizon economies.

A stable manifold and a phase plane

In addition to what’s in Anaconda, this lecture will need the following libraries:

!pip install quantecon

Show code cell output

Collecting quantecon

Downloading quantecon-0.8.1-py3-none-any.whl.metadata (5.2 kB)

Requirement already satisfied: numba>=0.49.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (0.60.0)

Requirement already satisfied: numpy>=1.17.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (1.26.4)

Requirement already satisfied: requests in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (2.32.3)

Requirement already satisfied: scipy>=1.5.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (1.13.1)

Requirement already satisfied: sympy in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (1.14.0)

Requirement already satisfied: llvmlite<0.44,>=0.43.0dev0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from numba>=0.49.0->quantecon) (0.43.0)

Requirement already satisfied: charset-normalizer<4,>=2 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (3.3.2)

Requirement already satisfied: idna<4,>=2.5 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (3.7)

Requirement already satisfied: urllib3<3,>=1.21.1 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (2.2.3)

Requirement already satisfied: certifi>=2017.4.17 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (2024.8.30)

Requirement already satisfied: mpmath<1.4,>=1.1.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from sympy->quantecon) (1.3.0)

Downloading quantecon-0.8.1-py3-none-any.whl (322 kB)

Installing collected packages: quantecon

Successfully installed quantecon-0.8.1

Let’s start with some standard imports:

import matplotlib.pyplot as plt

from numba import jit, float64

from numba.experimental import jitclass

import numpy as np

from quantecon.optimize import brentq

34.2. The Model#

Time is discrete and takes values

(We’ll eventually study a limiting case in which

A single good can either be consumed or invested in physical capital.

The consumption good is not durable and depreciates completely if not consumed immediately.

The capital good is durable but depreciates.

We let

Let

Let

34.2.1. Digression: Aggregation Theory#

We use a concept of a representative consumer to be thought of as follows.

There is a unit mass of identical consumers indexed by

Consumption of consumer

Aggregate consumption is

Consider a welfare problem that chooses an allocation

where

Form a Lagrangian

Differentiate under the integral signs with respect to each

These conditions imply that

To find

This line of argument indicates the special aggregation theory that lies beneath outcomes in which a representative consumer

consumes amount

It appears often in aggregate economics.

We shall use this aggregation theory here and also in this lecture Cass-Koopmans Competitive Equilibrium.

34.2.1.1. An Economy#

A representative household is endowed with one unit of labor at each

The representative household inelastically supplies a single unit of

labor

The representative household has preferences over consumption bundles ordered by the utility functional:

where

Larger

Note that

satisfies

We assume that

There is an economy-wide production function

with

A feasible allocation

where

34.3. Planning Problem#

A planner chooses an allocation

Let

To find an optimal allocation, form a Lagrangian

and pose the following min-max problem:

Extremization means maximization with respect to

Our problem satisfies conditions that assure that second-order conditions are satisfied at an allocation that satisfies the first-order necessary conditions that we are about to compute.

Before computing first-order conditions, we present some handy formulas.

34.3.1. Useful Properties of Linearly Homogeneous Production Function#

The following technicalities will help us.

Notice that

Define the output per-capita production function

whose argument is capital per-capita.

It is useful to recall the following calculations for the marginal product of capital

and the marginal product of labor

(Here we are using that

34.3.2. First-order necessary conditions#

We now compute first-order necessary conditions for extremization of Lagrangian (34.6):

In computing (34.10) we recognize that

Restrictions (34.12) come from differentiating with respect

to

Combining (34.9) and (34.10) gives

which can be rearranged to become

Applying the inverse marginal utility of consumption function on both sides of the above equation gives

which for our utility function (34.3) becomes the consumption Euler equation

which we can combine with the feasibility constraint (34.5) to get

This is a pair of non-linear first-order difference equations that map

It must also satisfy the initial condition that

Below we define a jitclass that stores parameters and functions

that define our economy.

planning_data = [

('γ', float64), # Coefficient of relative risk aversion

('β', float64), # Discount factor

('δ', float64), # Depreciation rate on capital

('α', float64), # Return to capital per capita

('A', float64) # Technology

]

@jitclass(planning_data)

class PlanningProblem():

def __init__(self, γ=2, β=0.95, δ=0.02, α=0.33, A=1):

self.γ, self.β = γ, β

self.δ, self.α, self.A = δ, α, A

def u(self, c):

'''

Utility function

ASIDE: If you have a utility function that is hard to solve by hand

you can use automatic or symbolic differentiation

See https://github.com/HIPS/autograd

'''

γ = self.γ

return c ** (1 - γ) / (1 - γ) if γ!= 1 else np.log(c)

def u_prime(self, c):

'Derivative of utility'

γ = self.γ

return c ** (-γ)

def u_prime_inv(self, c):

'Inverse of derivative of utility'

γ = self.γ

return c ** (-1 / γ)

def f(self, k):

'Production function'

α, A = self.α, self.A

return A * k ** α

def f_prime(self, k):

'Derivative of production function'

α, A = self.α, self.A

return α * A * k ** (α - 1)

def f_prime_inv(self, k):

'Inverse of derivative of production function'

α, A = self.α, self.A

return (k / (A * α)) ** (1 / (α - 1))

def next_k_c(self, k, c):

''''

Given the current capital Kt and an arbitrary feasible

consumption choice Ct, computes Kt+1 by state transition law

and optimal Ct+1 by Euler equation.

'''

β, δ = self.β, self.δ

u_prime, u_prime_inv = self.u_prime, self.u_prime_inv

f, f_prime = self.f, self.f_prime

k_next = f(k) + (1 - δ) * k - c

c_next = u_prime_inv(u_prime(c) / (β * (f_prime(k_next) + (1 - δ))))

return k_next, c_next

We can construct an economy with the Python code:

pp = PlanningProblem()

34.4. Shooting Algorithm#

We use shooting to compute an optimal allocation

First-order necessary conditions (34.9), (34.10), and (34.11) for the planning problem form a system of difference equations with two boundary conditions:

We have no initial condition for the Lagrange multiplier

If we did, our job would be easy:

Given

We could continue in this way to compute the remaining elements of

However, we woujld not be assured that the Kuhn-Tucker condition (34.13) would be satisfied.

Furthermore, we don’t have an initial condition for

So this won’t work.

Indeed, part of our task is to compute the optimal value of

To compute

It is called the shooting algorithm.

It is an instance of a guess and verify algorithm that consists of the following steps:

Guess an initial Lagrange multiplier

Apply the simple algorithm described above.

Compute

If

If

If

The following Python code implements the shooting algorithm for the planning problem.

(Actually, we modified the preceding algorithm slightly by starting with a guess for

@jit

def shooting(pp, c0, k0, T=10):

'''

Given the initial condition of capital k0 and an initial guess

of consumption c0, computes the whole paths of c and k

using the state transition law and Euler equation for T periods.

'''

if c0 > pp.f(k0) + (1 - pp.δ) * k0:

print("initial consumption is not feasible")

return None

# initialize vectors of c and k

c_vec = np.empty(T+1)

k_vec = np.empty(T+2)

c_vec[0] = c0

k_vec[0] = k0

for t in range(T):

k_vec[t+1], c_vec[t+1] = pp.next_k_c(k_vec[t], c_vec[t])

k_vec[T+1] = pp.f(k_vec[T]) + (1 - pp.δ) * k_vec[T] - c_vec[T]

return c_vec, k_vec

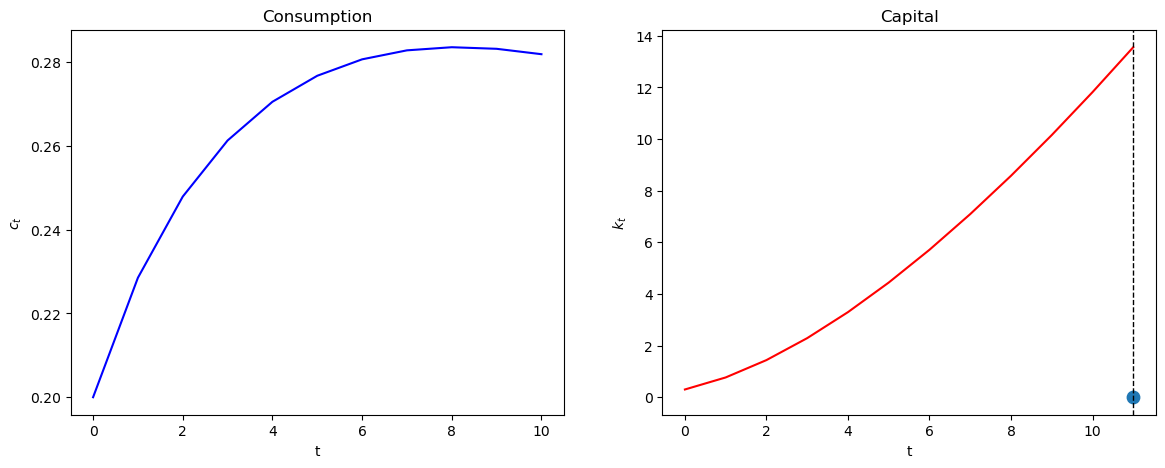

We’ll start with an incorrect guess.

paths = shooting(pp, 0.2, 0.3, T=10)

fig, axs = plt.subplots(1, 2, figsize=(14, 5))

colors = ['blue', 'red']

titles = ['Consumption', 'Capital']

ylabels = ['$c_t$', '$k_t$']

T = paths[0].size - 1

for i in range(2):

axs[i].plot(paths[i], c=colors[i])

axs[i].set(xlabel='t', ylabel=ylabels[i], title=titles[i])

axs[1].scatter(T+1, 0, s=80)

axs[1].axvline(T+1, color='k', ls='--', lw=1)

plt.show()

Evidently, our initial guess for

We know this because we miss our

Now we automate things with a search-for-a-good

We use a bisection method.

We make an initial guess for

We know that the lowest

Guess

If

If

Make a new guess for

Shoot forward again, iterating on these steps until we converge.

When

@jit

def bisection(pp, c0, k0, T=10, tol=1e-4, max_iter=500, k_ter=0, verbose=True):

# initial boundaries for guess c0

c0_upper = pp.f(k0) + (1 - pp.δ) * k0

c0_lower = 0

i = 0

while True:

c_vec, k_vec = shooting(pp, c0, k0, T)

error = k_vec[-1] - k_ter

# check if the terminal condition is satisfied

if np.abs(error) < tol:

if verbose:

print('Converged successfully on iteration ', i+1)

return c_vec, k_vec

i += 1

if i == max_iter:

if verbose:

print('Convergence failed.')

return c_vec, k_vec

# if iteration continues, updates boundaries and guess of c0

if error > 0:

c0_lower = c0

else:

c0_upper = c0

c0 = (c0_lower + c0_upper) / 2

def plot_paths(pp, c0, k0, T_arr, k_ter=0, k_ss=None, axs=None):

if axs is None:

fix, axs = plt.subplots(1, 3, figsize=(16, 4))

ylabels = ['$c_t$', '$k_t$', r'$\mu_t$']

titles = ['Consumption', 'Capital', 'Lagrange Multiplier']

c_paths = []

k_paths = []

for T in T_arr:

c_vec, k_vec = bisection(pp, c0, k0, T, k_ter=k_ter, verbose=False)

c_paths.append(c_vec)

k_paths.append(k_vec)

μ_vec = pp.u_prime(c_vec)

paths = [c_vec, k_vec, μ_vec]

for i in range(3):

axs[i].plot(paths[i])

axs[i].set(xlabel='t', ylabel=ylabels[i], title=titles[i])

# Plot steady state value of capital

if k_ss is not None:

axs[1].axhline(k_ss, c='k', ls='--', lw=1)

axs[1].axvline(T+1, c='k', ls='--', lw=1)

axs[1].scatter(T+1, paths[1][-1], s=80)

return c_paths, k_paths

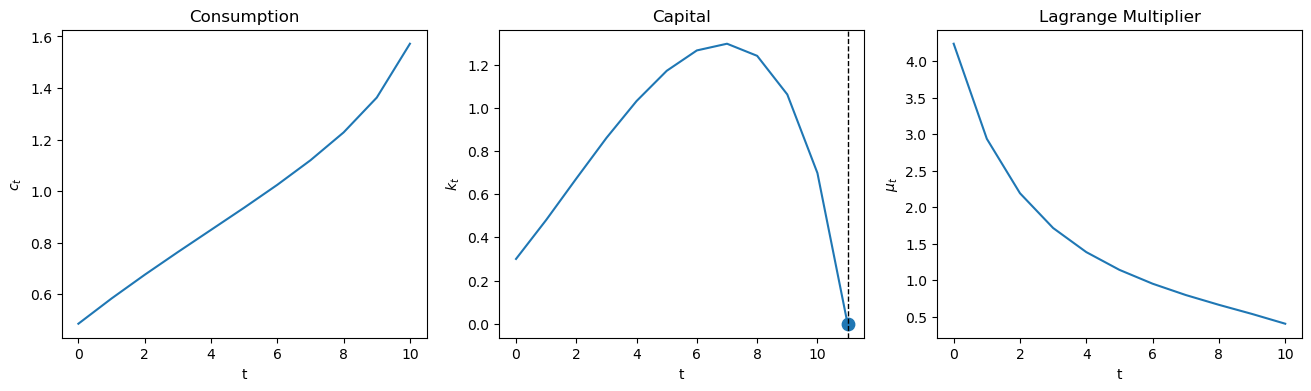

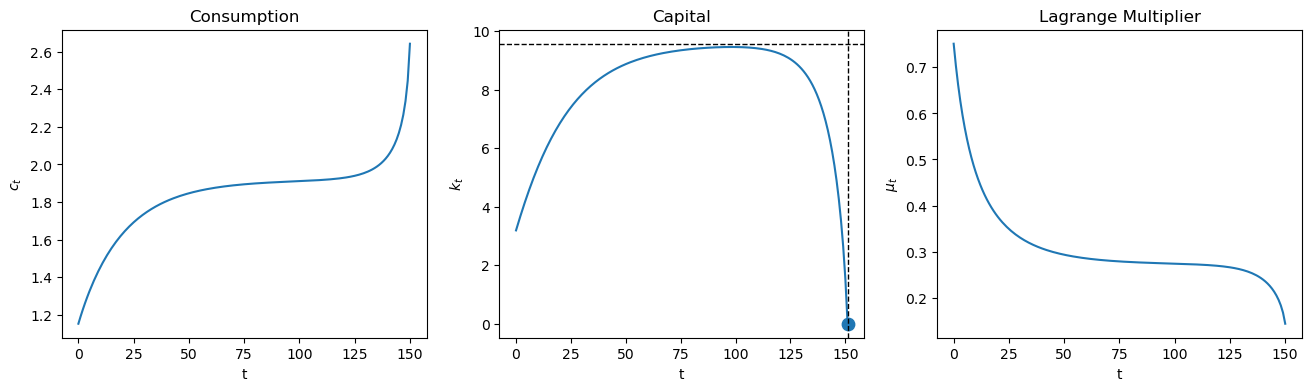

Now we can solve the model and plot the paths of consumption, capital, and Lagrange multiplier.

plot_paths(pp, 0.3, 0.3, [10]);

34.5. Setting Initial Capital to Steady State Capital#

When

It is instructive to set

In a steady state

Evalauating feasibility constraint (34.5) at

Substituting

Defining

Simplifying gives

and

For production function (34.4), this becomes

As an example, after setting

Let’s verify this with Python and then use this steady state

ρ = 1 / pp.β - 1

k_ss = pp.f_prime_inv(ρ+pp.δ)

print(f'steady state for capital is: {k_ss}')

steady state for capital is: 9.57583816331462

Now we plot

plot_paths(pp, 0.3, k_ss, [150], k_ss=k_ss);

Evidently, with a large value of

Let’s see what the planner does when we set

plot_paths(pp, 0.3, k_ss/3, [150], k_ss=k_ss);

Notice how the planner pushes capital toward the steady state, stays

near there for a while, then pushes

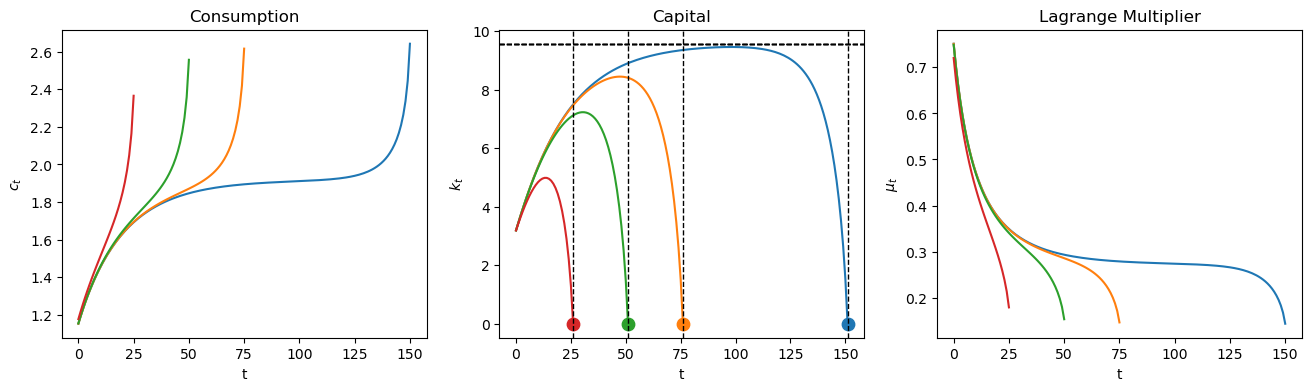

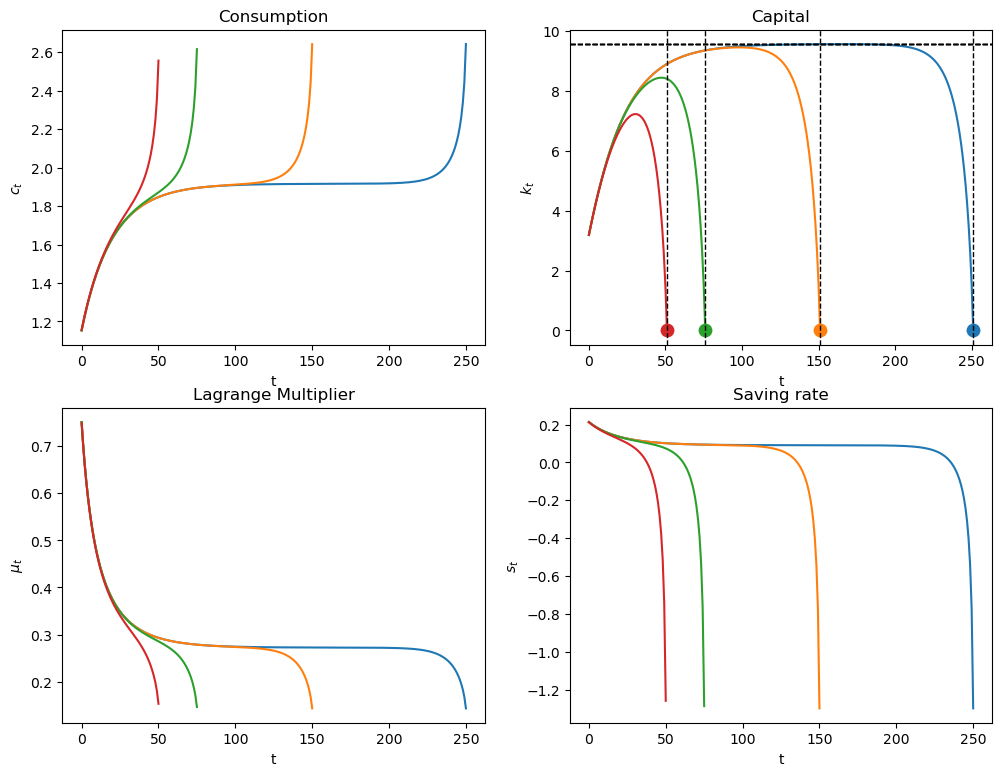

The following graphs compare optimal outcomes as we vary

plot_paths(pp, 0.3, k_ss/3, [150, 75, 50, 25], k_ss=k_ss);

34.6. A Turnpike Property#

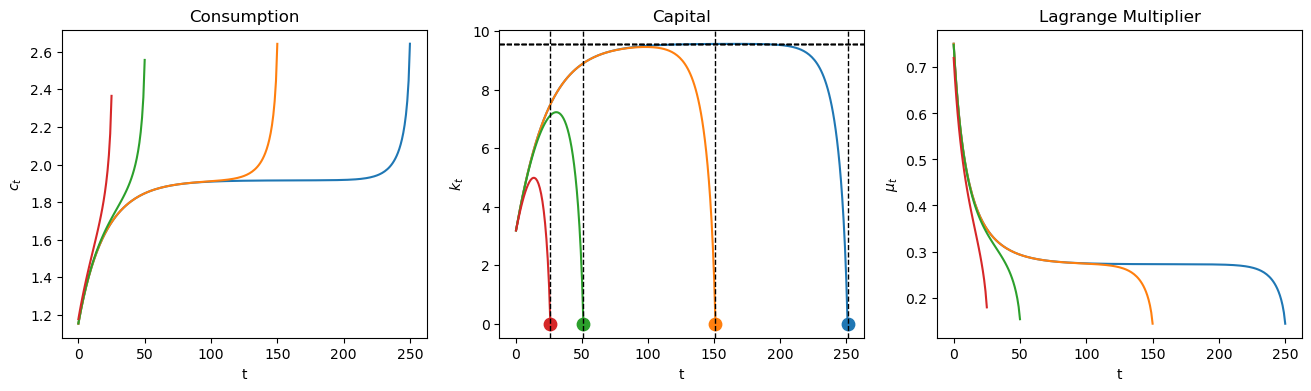

The following calculation indicates that when

plot_paths(pp, 0.3, k_ss/3, [250, 150, 50, 25], k_ss=k_ss);

In the above graphs, different colors are associated with

different horizons

Notice that as the horizon increases, the planner keeps

This pattern reflects a turnpike property of the steady state.

A rule of thumb for the planner is

from

The planner accomplishes this by adjusting the saving rate

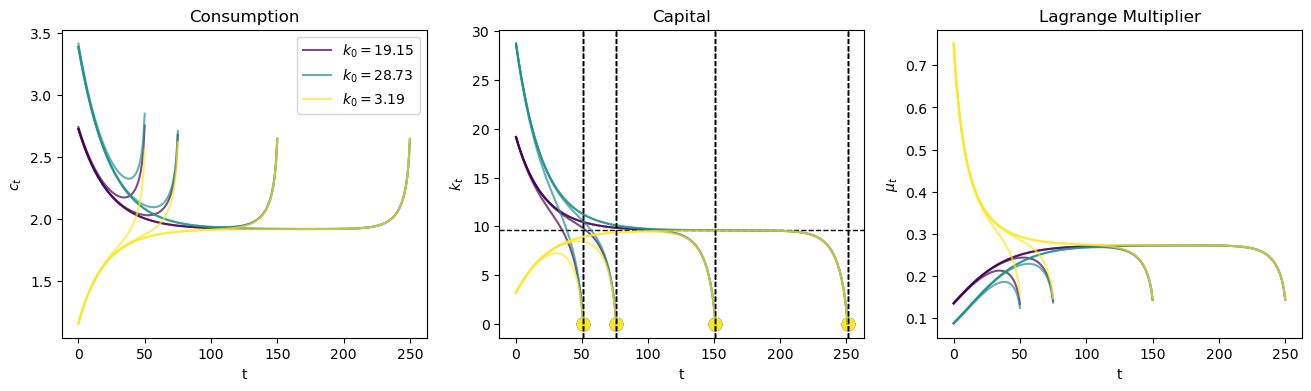

Exercise 34.1

The turnpike property is independent of the initial condition

Expand the plot_paths function so that it plots trajectories for multiple initial points using k0s = [k_ss*2, k_ss*3, k_ss/3].

Solution to Exercise 34.1

Here is one solution

def plot_multiple_paths(pp, c0, k0s, T_arr, k_ter=0, k_ss=None, axs=None):

if axs is None:

fig, axs = plt.subplots(1, 3, figsize=(16, 4))

ylabels = ['$c_t$', '$k_t$', r'$\mu_t$']

titles = ['Consumption', 'Capital', 'Lagrange Multiplier']

colors = plt.cm.viridis(np.linspace(0, 1, len(k0s)))

all_c_paths = []

all_k_paths = []

for i, k0 in enumerate(k0s):

k0_c_paths = []

k0_k_paths = []

for T in T_arr:

c_vec, k_vec = bisection(pp, c0, k0, T, k_ter=k_ter, verbose=False)

k0_c_paths.append(c_vec)

k0_k_paths.append(k_vec)

μ_vec = pp.u_prime(c_vec)

paths = [c_vec, k_vec, μ_vec]

for j in range(3):

axs[j].plot(paths[j], color=colors[i],

label=f'$k_0 = {k0:.2f}$' if j == 0 and T == T_arr[0] else "", alpha=0.7)

axs[j].set(xlabel='t', ylabel=ylabels[j], title=titles[j])

if k_ss is not None and i == 0 and T == T_arr[0]:

axs[1].axhline(k_ss, c='k', ls='--', lw=1)

axs[1].axvline(T+1, c='k', ls='--', lw=1)

axs[1].scatter(T+1, paths[1][-1], s=80, color=colors[i])

all_c_paths.append(k0_c_paths)

all_k_paths.append(k0_k_paths)

# Add legend if multiple initial points

if len(k0s) > 1:

axs[0].legend()

return all_c_paths, all_k_paths

_ = plot_multiple_paths(pp, 0.3, [k_ss*2, k_ss*3, k_ss/3], [250, 150, 75, 50], k_ss=k_ss)

We see that the turnpike property holds for various initial values of

Let’s calculate and plot the saving rate.

@jit

def saving_rate(pp, c_path, k_path):

'Given paths of c and k, computes the path of saving rate.'

production = pp.f(k_path[:-1])

return (production - c_path) / production

def plot_saving_rate(pp, c0, k0, T_arr, k_ter=0, k_ss=None, s_ss=None):

fix, axs = plt.subplots(2, 2, figsize=(12, 9))

c_paths, k_paths = plot_paths(pp, c0, k0, T_arr, k_ter=k_ter, k_ss=k_ss, axs=axs.flatten())

for i, T in enumerate(T_arr):

s_path = saving_rate(pp, c_paths[i], k_paths[i])

axs[1, 1].plot(s_path)

axs[1, 1].set(xlabel='t', ylabel='$s_t$', title='Saving rate')

if s_ss is not None:

axs[1, 1].hlines(s_ss, 0, np.max(T_arr), linestyle='--')

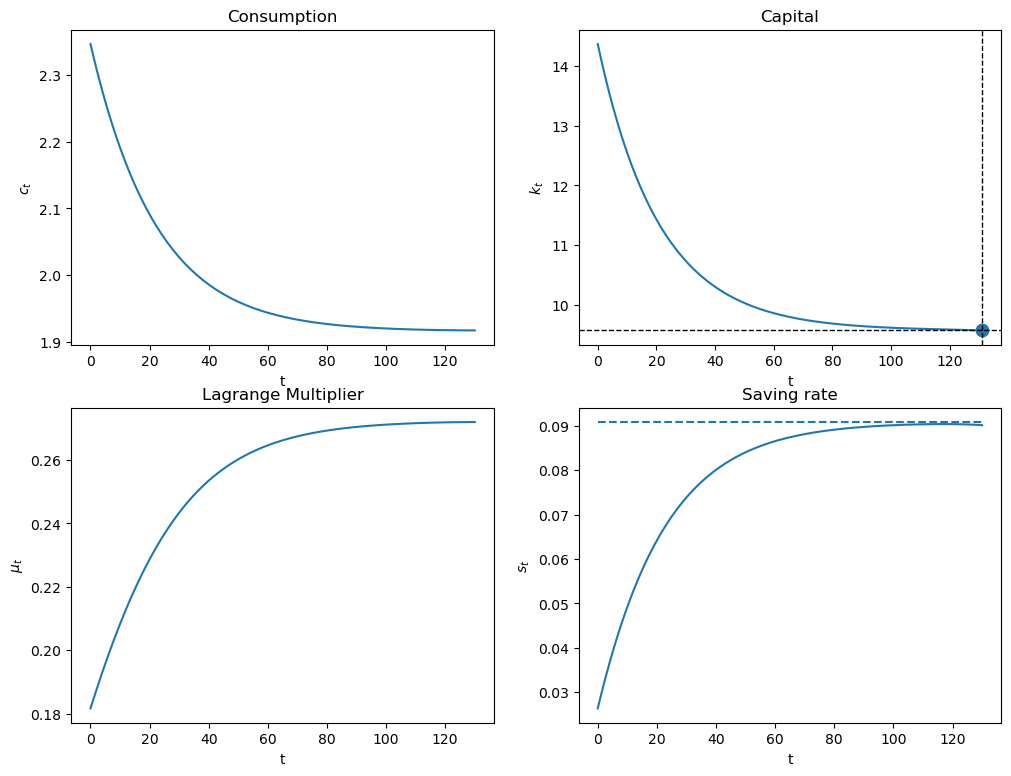

plot_saving_rate(pp, 0.3, k_ss/3, [250, 150, 75, 50], k_ss=k_ss)

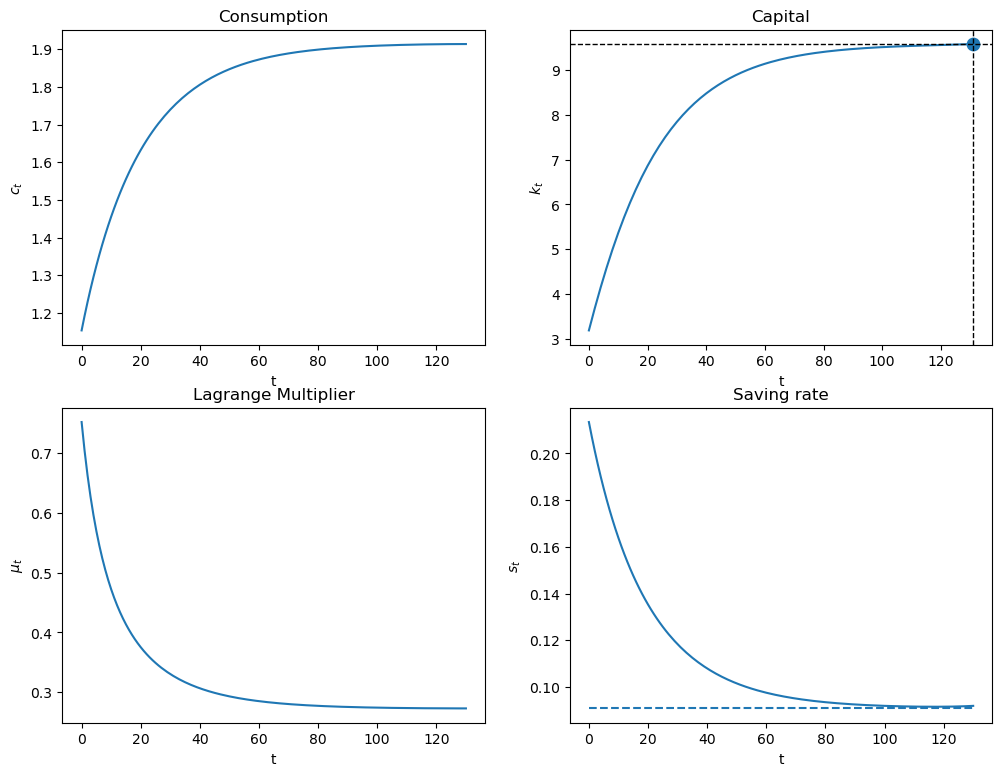

34.7. A Limiting Infinite Horizon Economy#

We want to set

The appropriate thing to do is to replace terminal condition (34.12) with

a condition that will be satisfied by a path that converges to an optimal steady state.

We can approximate the optimal path by starting from an arbitrary initial

In the following code, we do this for a large

We know that in the steady state that the saving rate is constant

and that

From (34.17) the steady state saving rate equals

The steady state saving rate

We first study optimal capital paths that start below the steady state.

# steady state of saving rate

s_ss = pp.δ * k_ss / pp.f(k_ss)

plot_saving_rate(pp, 0.3, k_ss/3, [130], k_ter=k_ss, k_ss=k_ss, s_ss=s_ss)

Since

The planner chooses a positive saving rate that is higher than the steady state saving rate.

Note that

The planner slowly lowers the saving rate until reaching a steady

state in which

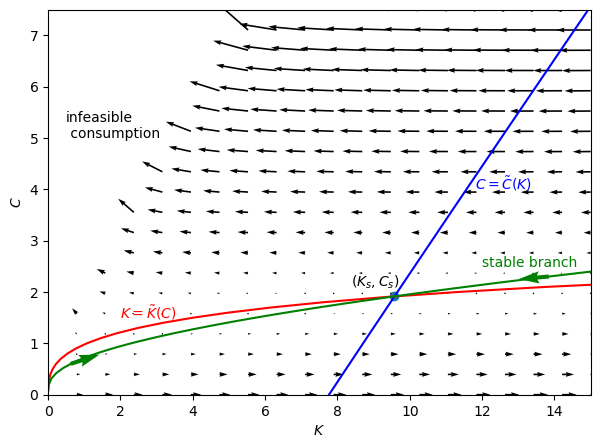

34.8. Stable Manifold and Phase Diagram#

We now describe a classic diagram that describes an optimal

The diagram has

Given an arbitrary and fixed

which implies

A positive fixed point

@jit

def C_tilde(K, pp):

return pp.f(K) + (1 - pp.δ) * K - pp.f_prime_inv(1 / pp.β - 1 + pp.δ)

Next note that given a time-invariant arbitrary

A fixed point of the above equation is described by a function

@jit

def K_diff(K, C, pp):

return pp.f(K) - pp.δ * K - C

@jit

def K_tilde(C, pp):

res = brentq(K_diff, 1e-6, 100, args=(C, pp))

return res.root

A steady state

It is thus the intersection of the two curves

We can compute

@jit

def K_tilde_diff(K, pp):

K_out = K_tilde(C_tilde(K, pp), pp)

return K - K_out

res = brentq(K_tilde_diff, 8, 10, args=(pp,))

Ks = res.root

Cs = C_tilde(Ks, pp)

Ks, Cs

(9.575838163314447, 1.9160839808123402)

We can use the shooting algorithm to compute trajectories that approach

For a given

We compute

Let’s compute two trajectories towards

c_vec1, k_vec1 = bisection(pp, 5, 15, T=200, k_ter=Ks)

c_vec2, k_vec2 = bisection(pp, 1e-3, 1e-3, T=200, k_ter=Ks)

Converged successfully on iteration 46

Converged successfully on iteration 51

The following code generates Figure Fig. 34.1, which is patterned on a graph that appears on page 411 of [Intriligator, 2002].

Figure Fig. 34.1 is a classic “phase plane” with “state” variable

Figure Fig. 34.1 plots three curves:

the blue line graphs

the red line graphs

the green line graphs the stable traced out by paths that converge to the steady state starting from an arbitrary

for a given

the arrows on the green line show the direction in which dynamics (34.16) push successive

In addition to the three curves, Figure Fig. 34.1 plots arrows that point where the dynamics (34.16) drive the system when, for a given

If

If

Show code cell source

fig, ax = plt.subplots(figsize=(7, 5))

K_range = np.arange(1e-1, 15, 0.1)

C_range = np.arange(1e-1, 2.3, 0.1)

# C tilde

ax.plot(K_range, [C_tilde(Ks, pp) for Ks in K_range], color='b')

ax.text(11.8, 4, r'$C=\tilde{C}(K)$', color='b')

# K tilde

ax.plot([K_tilde(Cs, pp) for Cs in C_range], C_range, color='r')

ax.text(2, 1.5, r'$K=\tilde{K}(C)$', color='r')

# stable branch

ax.plot(k_vec1[:-1], c_vec1, color='g')

ax.plot(k_vec2[:-1], c_vec2, color='g')

ax.quiver(k_vec1[5], c_vec1[5],

k_vec1[6]-k_vec1[5], c_vec1[6]-c_vec1[5],

color='g')

ax.quiver(k_vec2[5], c_vec2[5],

k_vec2[6]-k_vec2[5], c_vec2[6]-c_vec2[5],

color='g')

ax.text(12, 2.5, r'stable branch', color='g')

# (Ks, Cs)

ax.scatter(Ks, Cs)

ax.text(Ks-1.2, Cs+0.2, '$(K_s, C_s)$')

# arrows

K_range = np.linspace(1e-3, 15, 20)

C_range = np.linspace(1e-3, 7.5, 20)

K_mesh, C_mesh = np.meshgrid(K_range, C_range)

next_K, next_C = pp.next_k_c(K_mesh, C_mesh)

ax.quiver(K_range, C_range, next_K-K_mesh, next_C-C_mesh)

# infeasible consumption area

ax.text(0.5, 5, "infeasible\n consumption")

ax.set_ylim([0, 7.5])

ax.set_xlim([0, 15])

ax.set_xlabel('$K$')

ax.set_ylabel('$C$')

plt.show()

Fig. 34.1 Stable Manifold and Phase Plane#

34.9. Concluding Remarks#

In Cass-Koopmans Competitive Equilibrium, we study a decentralized version of an economy with exactly the same technology and preference structure as deployed here.

In that lecture, we replace the planner of this lecture with Adam Smith’s invisible hand.

In place of quantity choices made by the planner, there are market prices that are set by a deus ex machina from outside the model, a so-called invisible hand.

Equilibrium market prices must reconcile distinct decisions that are made independently by a representative household and a representative firm.

The relationship between a command economy like the one studied in this lecture and a market economy like that studied in Cass-Koopmans Competitive Equilibrium is a foundational topic in general equilibrium theory and welfare economics.

34.9.1. Exercise#

Exercise 34.2

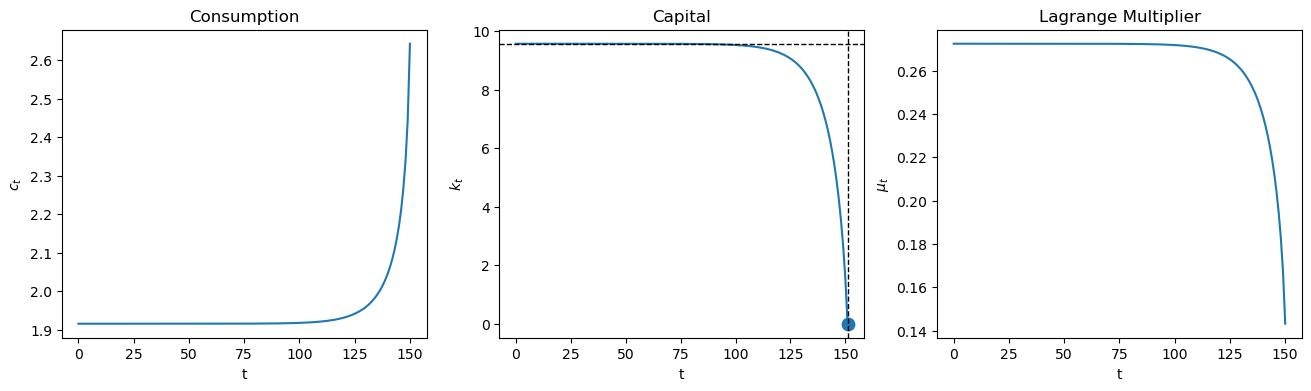

Plot the optimal consumption, capital, and saving paths when the initial capital level begins at 1.5 times the steady state level as we shoot towards the steady state at

Why does the saving rate respond as it does?

Solution to Exercise 34.2

plot_saving_rate(pp, 0.3, k_ss*1.5, [130], k_ter=k_ss, k_ss=k_ss, s_ss=s_ss)