62. Production Smoothing via Inventories#

Contents

In addition to what’s in Anaconda, this lecture employs the following library:

!pip install quantecon

Show code cell output

Requirement already satisfied: quantecon in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (0.8.1)

Requirement already satisfied: numba>=0.49.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (0.60.0)

Requirement already satisfied: numpy>=1.17.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (1.26.4)

Requirement already satisfied: requests in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (2.32.3)

Requirement already satisfied: scipy>=1.5.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (1.13.1)

Requirement already satisfied: sympy in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (1.14.0)

Requirement already satisfied: llvmlite<0.44,>=0.43.0dev0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from numba>=0.49.0->quantecon) (0.43.0)

Requirement already satisfied: charset-normalizer<4,>=2 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (3.3.2)

Requirement already satisfied: idna<4,>=2.5 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (3.7)

Requirement already satisfied: urllib3<3,>=1.21.1 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (2.2.3)

Requirement already satisfied: certifi>=2017.4.17 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (2024.8.30)

Requirement already satisfied: mpmath<1.4,>=1.1.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from sympy->quantecon) (1.3.0)

62.1. Overview#

This lecture can be viewed as an application of this quantecon lecture about linear quadratic control theory.

It formulates a discounted dynamic program for a firm that chooses a production schedule to balance

minimizing costs of production across time, against

keeping costs of holding inventories low

In the tradition of a classic book by Holt, Modigliani, Muth, and Simon [Holt et al., 1960], we simplify the firm’s problem by formulating it as a linear quadratic discounted dynamic programming problem of the type studied in this quantecon lecture.

Because its costs of production are increasing and quadratic in production, the firm holds inventories as a buffer stock in order to smooth production across time, provided that holding inventories is not too costly.

But the firm also wants to make its sales out of existing inventories, a preference that we represent by a cost that is quadratic in the difference between sales in a period and the firm’s beginning of period inventories.

We compute examples designed to indicate how the firm optimally smooths production while keeping inventories close to sales.

To introduce components of the model, let

a cost

a cost

the constant

To map our problem into a linear-quadratic discounted dynamic

programming problem (also known as an optimal linear regulator), we

define the state vector at time

and the control vector as

The law of motion for the state vector

or

(At this point, we ask that you please forgive us for using

We can express the firm’s profit as a function of states and controls as

To form the matrices

where

Remark on notation: The notation for cross product term in the

QuantEcon library is

The firms’ optimum decision rule takes the form

and the evolution of the state under the optimal decision rule is

The firm chooses a decision rule for

subject to a given

This is a stochastic discounted LQ dynamic program.

Here is code for computing an optimal decision rule and for analyzing its consequences.

import matplotlib.pyplot as plt

plt.rcParams["figure.figsize"] = (11, 5) #set default figure size

import numpy as np

import quantecon as qe

class SmoothingExample:

"""

Class for constructing, solving, and plotting results for

inventories and sales smoothing problem.

"""

def __init__(self,

β=0.96, # Discount factor

c1=1, # Cost-of-production

c2=1,

d1=1, # Cost-of-holding inventories

d2=1,

a0=10, # Inverse demand function

a1=1,

A22=[[1, 0], # z process

[1, 0.9]],

C2=[[0], [1]],

G=[0, 1]):

self.β = β

self.c1, self.c2 = c1, c2

self.d1, self.d2 = d1, d2

self.a0, self.a1 = a0, a1

self.A22 = np.atleast_2d(A22)

self.C2 = np.atleast_2d(C2)

self.G = np.atleast_2d(G)

# Dimensions

k, j = self.C2.shape # Dimensions for randomness part

n = k + 1 # Number of states

m = 2 # Number of controls

Sc = np.zeros(k)

Sc[0] = 1

# Construct matrices of transition law

A = np.zeros((n, n))

A[0, 0] = 1

A[1:, 1:] = self.A22

B = np.zeros((n, m))

B[0, :] = 1, -1

C = np.zeros((n, j))

C[1:, :] = self.C2

self.A, self.B, self.C = A, B, C

# Construct matrices of one period profit function

R = np.zeros((n, n))

R[0, 0] = d2

R[1:, 0] = d1 / 2 * Sc

R[0, 1:] = d1 / 2 * Sc

Q = np.zeros((m, m))

Q[0, 0] = c2

Q[1, 1] = a1 + d2

N = np.zeros((m, n))

N[1, 0] = - d2

N[0, 1:] = c1 / 2 * Sc

N[1, 1:] = - a0 / 2 * Sc - self.G / 2

self.R, self.Q, self.N = R, Q, N

# Construct LQ instance

self.LQ = qe.LQ(Q, R, A, B, C, N, beta=β)

self.LQ.stationary_values()

def simulate(self, x0, T=100):

c1, c2 = self.c1, self.c2

d1, d2 = self.d1, self.d2

a0, a1 = self.a0, self.a1

G = self.G

x_path, u_path, w_path = self.LQ.compute_sequence(x0, ts_length=T)

I_path = x_path[0, :-1]

z_path = x_path[1:, :-1]

𝜈_path = (G @ z_path)[0, :]

Q_path = u_path[0, :]

S_path = u_path[1, :]

revenue = (a0 - a1 * S_path + 𝜈_path) * S_path

cost_production = c1 * Q_path + c2 * Q_path ** 2

cost_inventories = d1 * I_path + d2 * (S_path - I_path) ** 2

Q_no_inventory = (a0 + 𝜈_path - c1) / (2 * (a1 + c2))

Q_hardwired = (a0 + 𝜈_path - c1) / (2 * (a1 + c2 + d2))

fig, ax = plt.subplots(2, 2, figsize=(15, 10))

ax[0, 0].plot(range(T), I_path, label="inventories")

ax[0, 0].plot(range(T), S_path, label="sales")

ax[0, 0].plot(range(T), Q_path, label="production")

ax[0, 0].legend(loc=1)

ax[0, 0].set_title("inventories, sales, and production")

ax[0, 1].plot(range(T), (Q_path - S_path), color='b')

ax[0, 1].set_ylabel("change in inventories", color='b')

span = max(abs(Q_path - S_path))

ax[0, 1].set_ylim(0-span*1.1, 0+span*1.1)

ax[0, 1].set_title("demand shock and change in inventories")

ax1_ = ax[0, 1].twinx()

ax1_.plot(range(T), 𝜈_path, color='r')

ax1_.set_ylabel("demand shock", color='r')

span = max(abs(𝜈_path))

ax1_.set_ylim(0-span*1.1, 0+span*1.1)

ax1_.plot([0, T], [0, 0], '--', color='k')

ax[1, 0].plot(range(T), revenue, label="revenue")

ax[1, 0].plot(range(T), cost_production, label="cost_production")

ax[1, 0].plot(range(T), cost_inventories, label="cost_inventories")

ax[1, 0].legend(loc=1)

ax[1, 0].set_title("profits decomposition")

ax[1, 1].plot(range(T), Q_path, label="production")

ax[1, 1].plot(range(T), Q_hardwired, label='production when $I_t$ \

forced to be zero')

ax[1, 1].plot(range(T), Q_no_inventory, label='production when \

inventories not useful')

ax[1, 1].legend(loc=1)

ax[1, 1].set_title('three production concepts')

plt.show()

Notice that the above code sets parameters at the following default values

discount factor

inverse demand function:

cost of production

costs of holding inventories

In the examples below, we alter some or all of these parameter values.

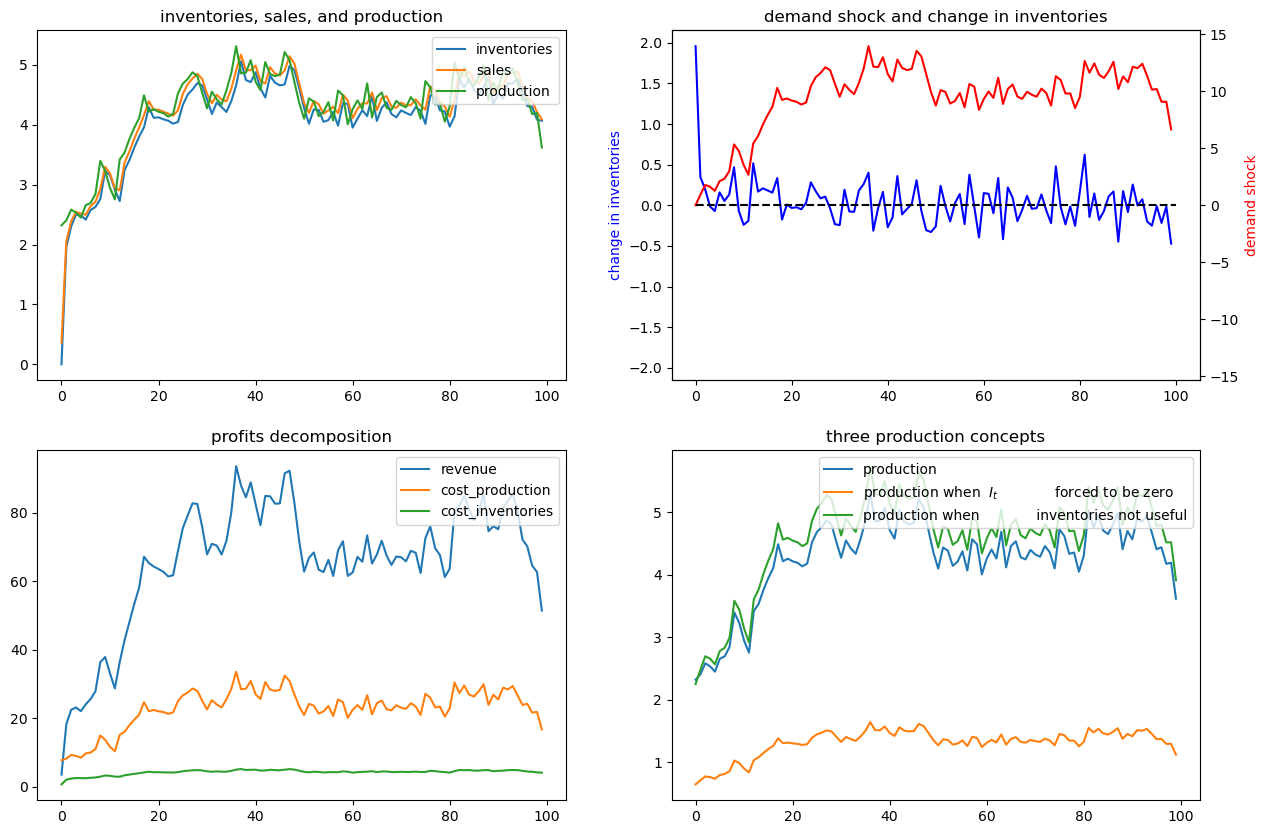

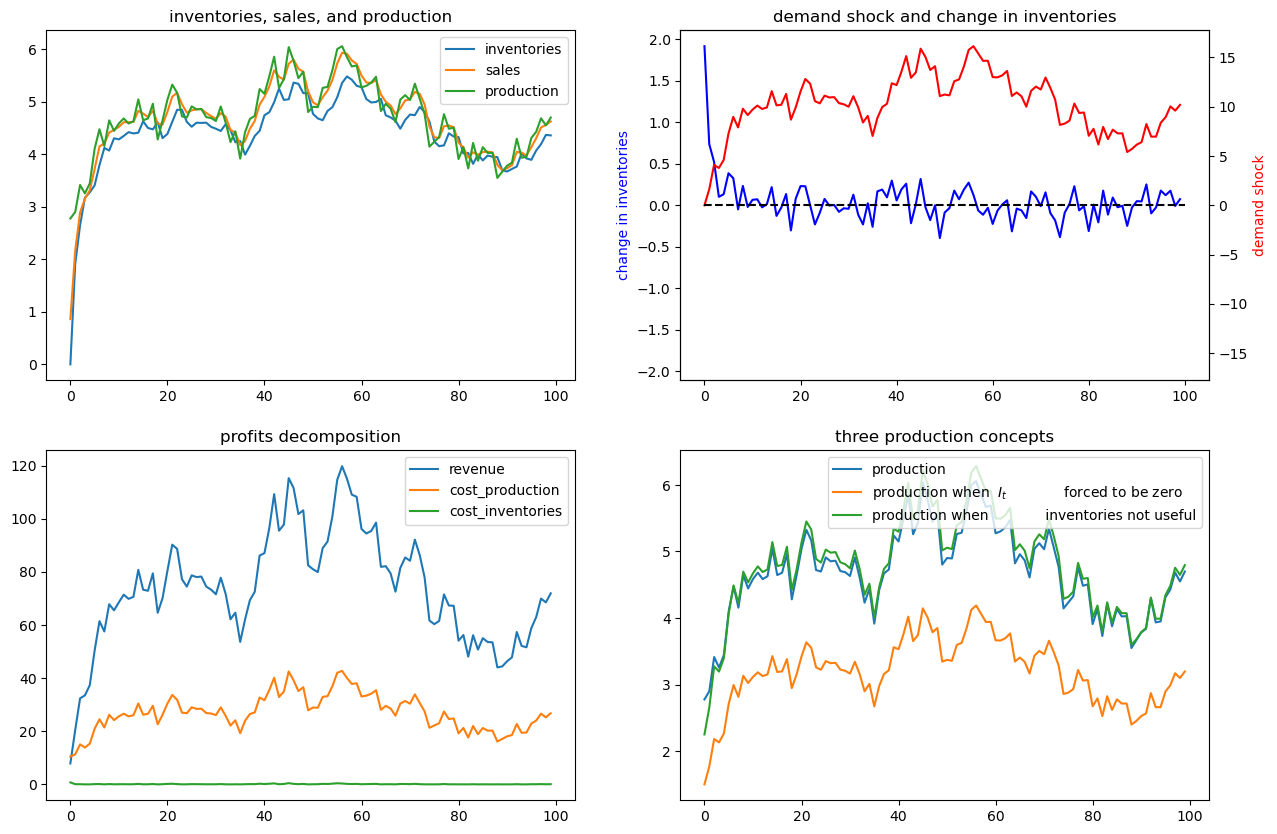

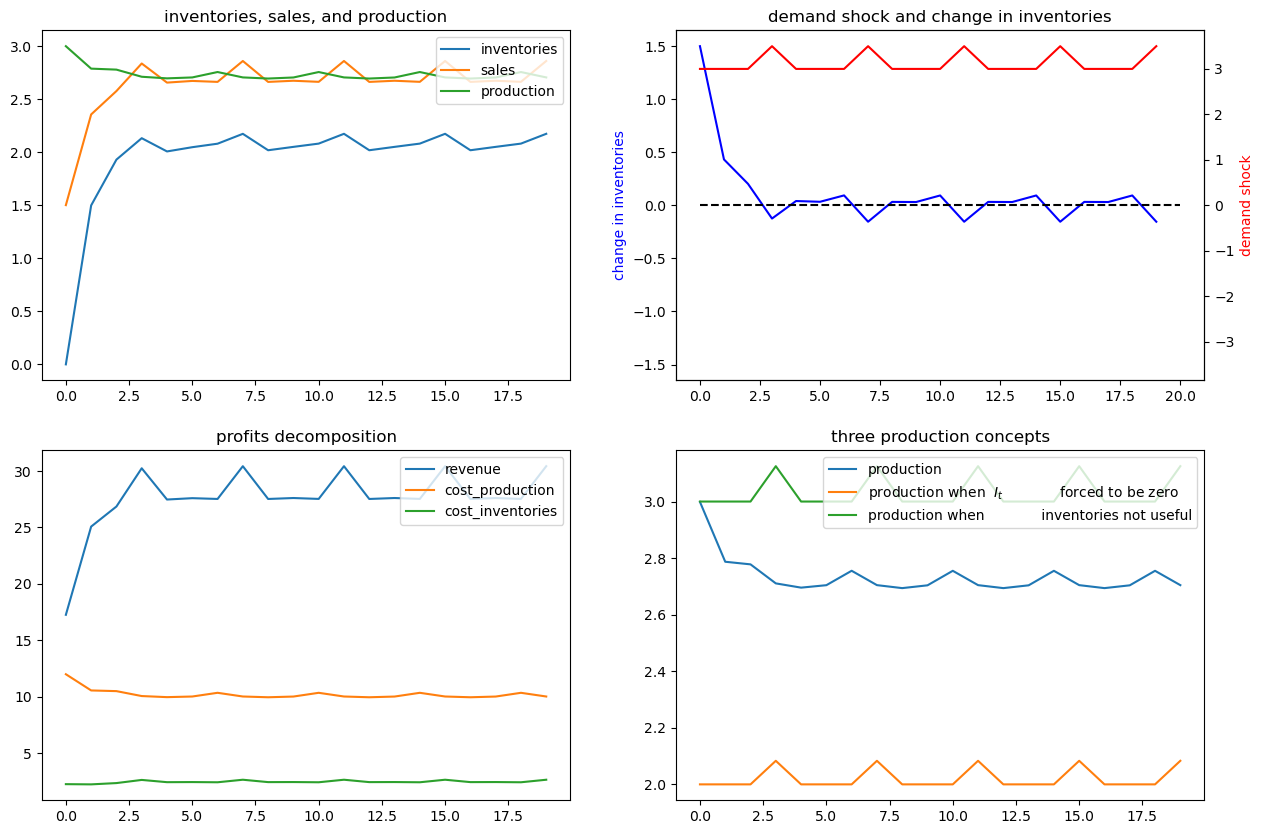

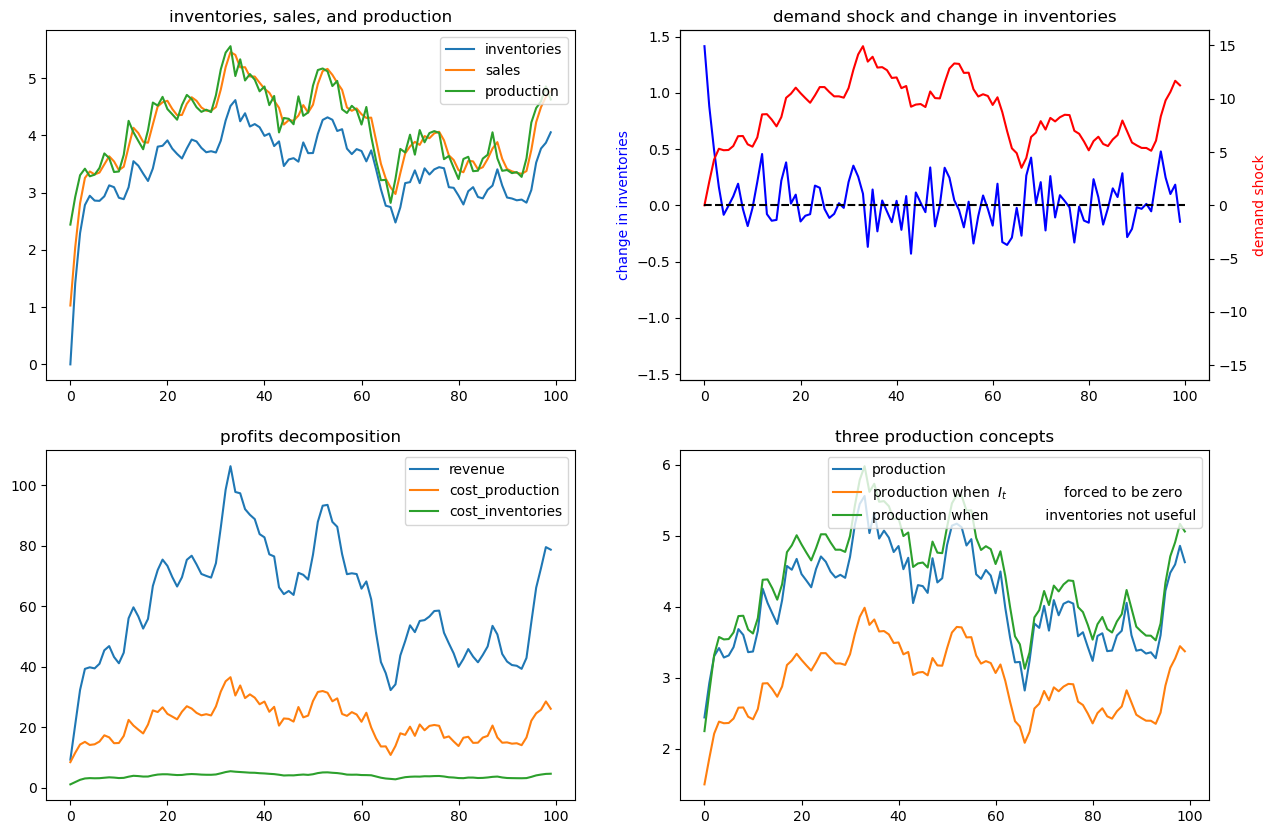

62.2. Example 1#

In this example, the demand shock follows AR(1) process:

which implies

We set

We’ll calculate and display outcomes, then discuss them below the pertinent figures.

ex1 = SmoothingExample()

x0 = [0, 1, 0]

ex1.simulate(x0)

The figures above illustrate various features of an optimal production plan.

Starting from zero inventories, the firm builds up a stock of inventories and uses them to smooth costly production in the face of demand shocks.

Optimal decisions evidently respond to demand shocks.

Inventories are always less than sales, so some sales come from current

production, a consequence of the cost,

The lower right panel shows differences between optimal production and two alternative production concepts that come from altering the firm’s cost structure – i.e., its technology.

These two concepts correspond to these distinct altered firm problems.

a setting in which inventories are not needed

a setting in which they are needed but we arbitrarily prevent the firm from holding inventories by forcing it to set

We use these two alternative production concepts in order to shed light on the baseline model.

62.3. Inventories Not Useful#

Let’s turn first to the setting in which inventories aren’t needed.

In this problem, the firm forms an output plan that maximizes the expected value of

It turns out that the optimal plan for

When inventories aren’t required or used, sales always equal production.

This simplifies the problem and the optimal no-inventory production maximizes the expected value of

The optimum decision rule is

62.4. Inventories Useful but are Hardwired to be Zero Always#

Next, we turn to a distinct problem in which inventories are useful –

meaning that there are costs of

Here the firm’s maximization problem is

subject to the restrictions that

The restriction that

Here the optimal production plan is

We introduce this

The bottom right panel displays a production path for the original

problem that we are interested in (the blue line) as well with an

optimal production path for the model in which inventories are not

useful (the green path) and also for the model in which, although

inventories are useful, they are hardwired to zero and the firm pays

cost

Notice that it is typically optimal for the firm to produce more when inventories aren’t useful. Here there is no requirement to sell out of inventories and no costs from having sales deviate from inventories.

But “typical” does not mean “always”.

Thus, if we look closely, we notice that for small

High optimal production in the original model early on occurs because the firm wants to accumulate inventories quickly in order to acquire high inventories for use in later periods.

But how the green line compares to the blue line early on depends on the evolution of the demand shock, as we will see in a deterministically seasonal demand shock example to be analyzed below.

In that example, the original firm optimally accumulates inventories slowly because the next positive demand shock is in the distant future.

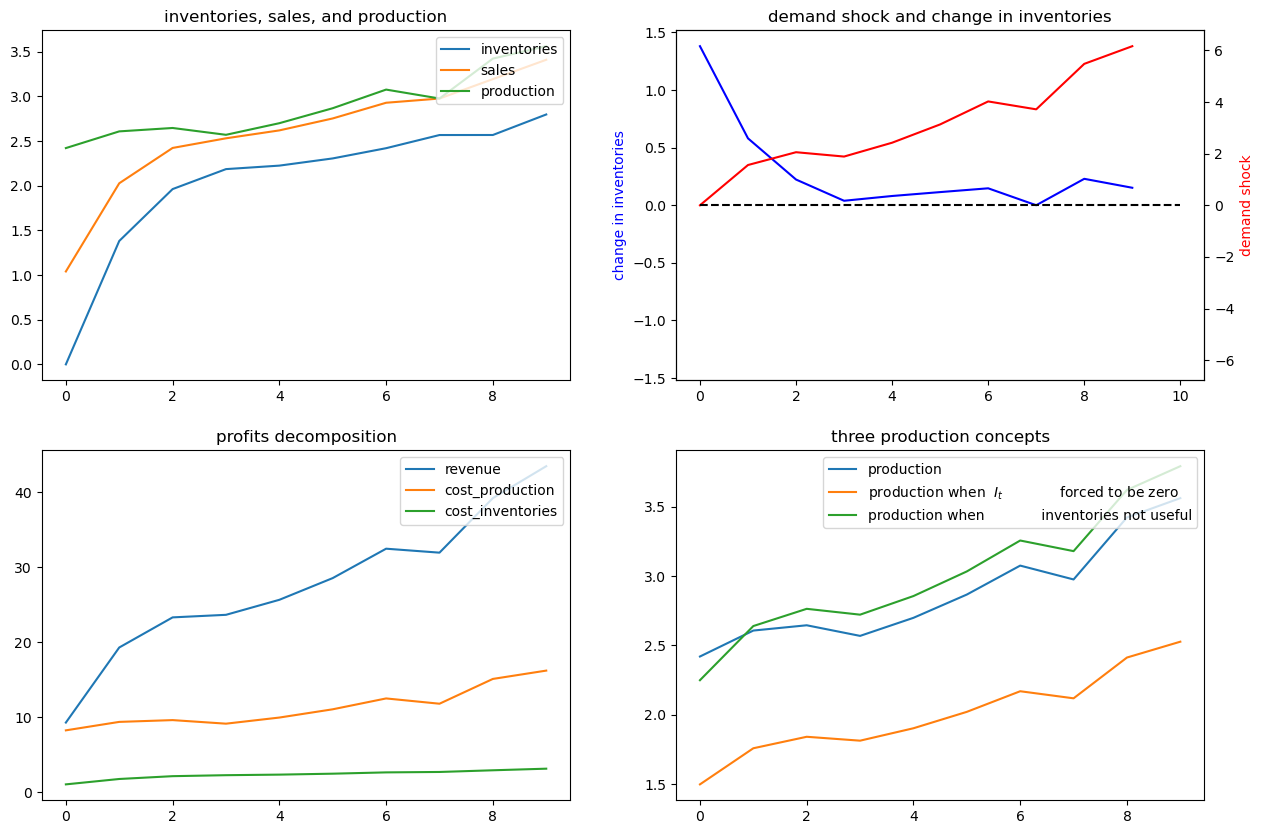

To make the green-blue model production comparison easier to see, let’s confine the graphs to the first 10 periods:

ex1.simulate(x0, T=10)

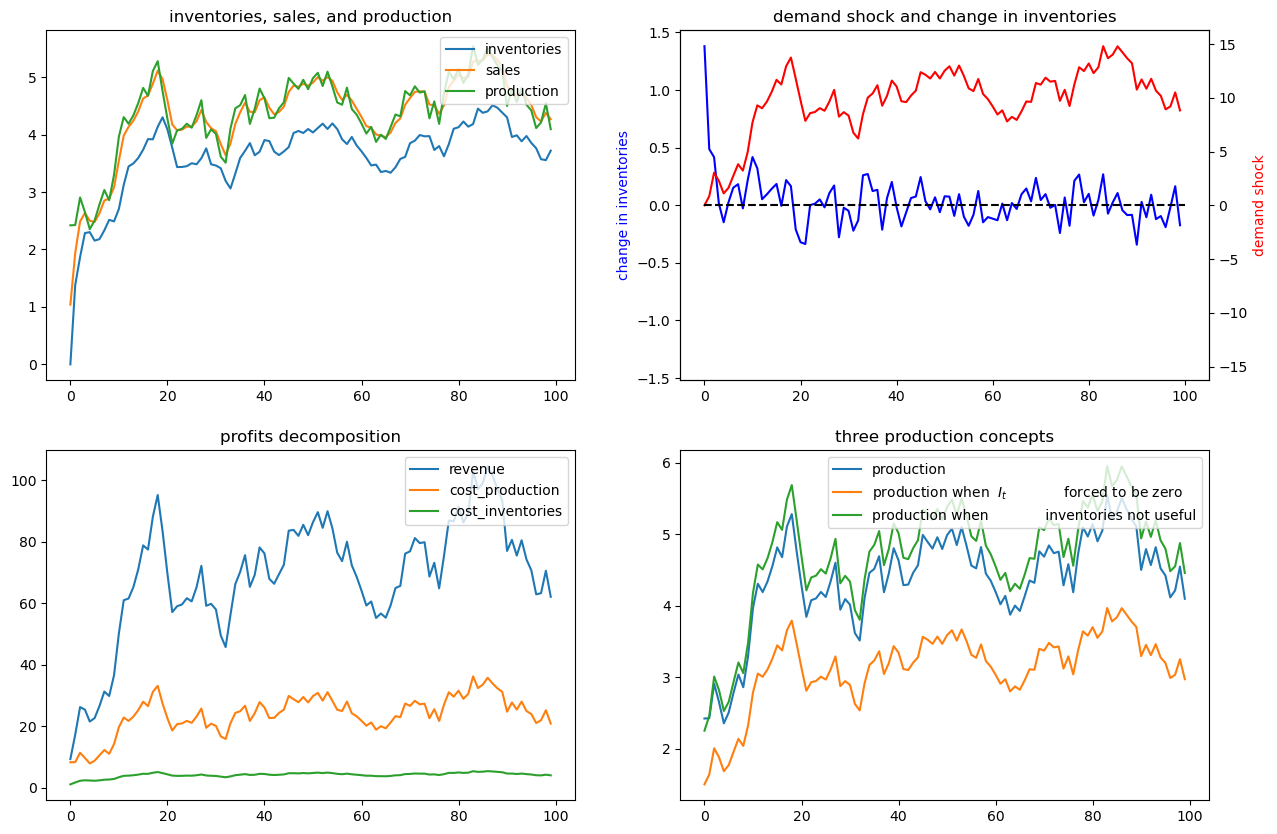

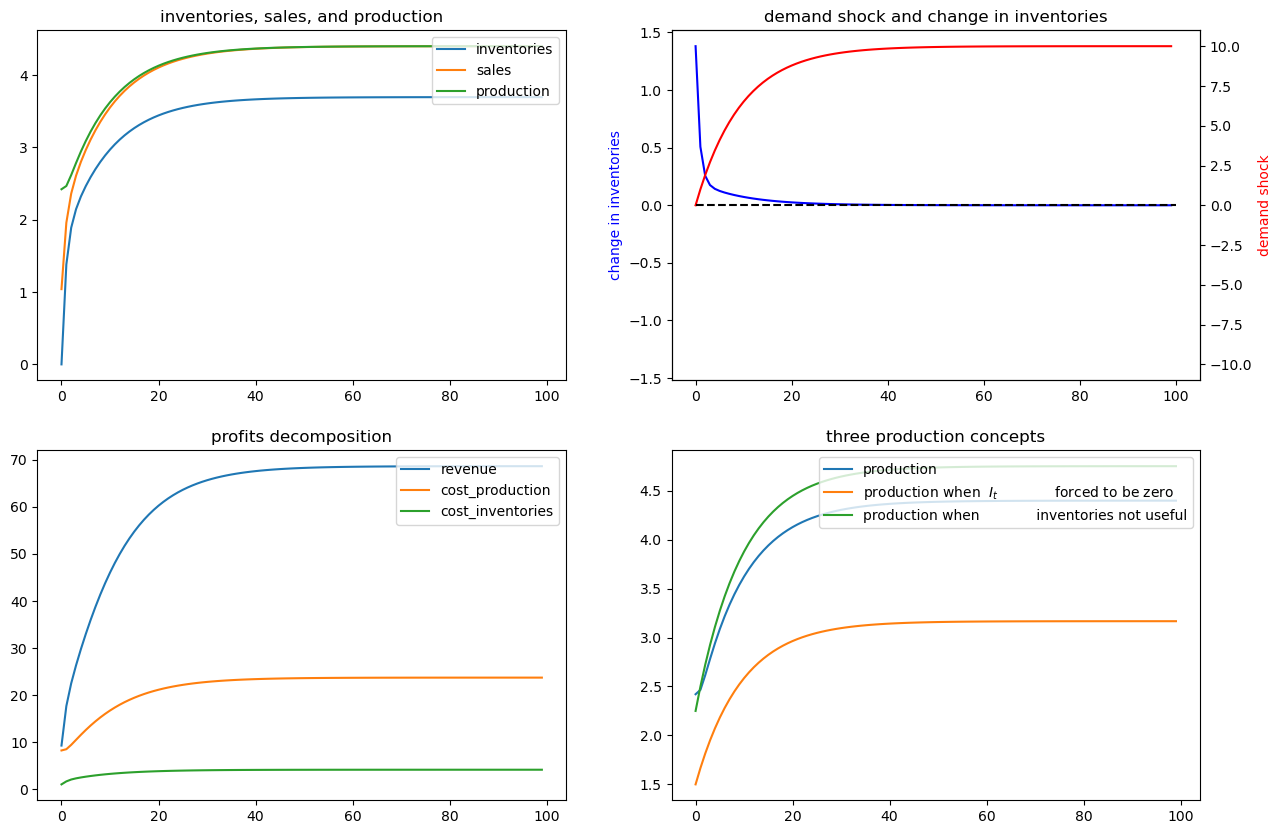

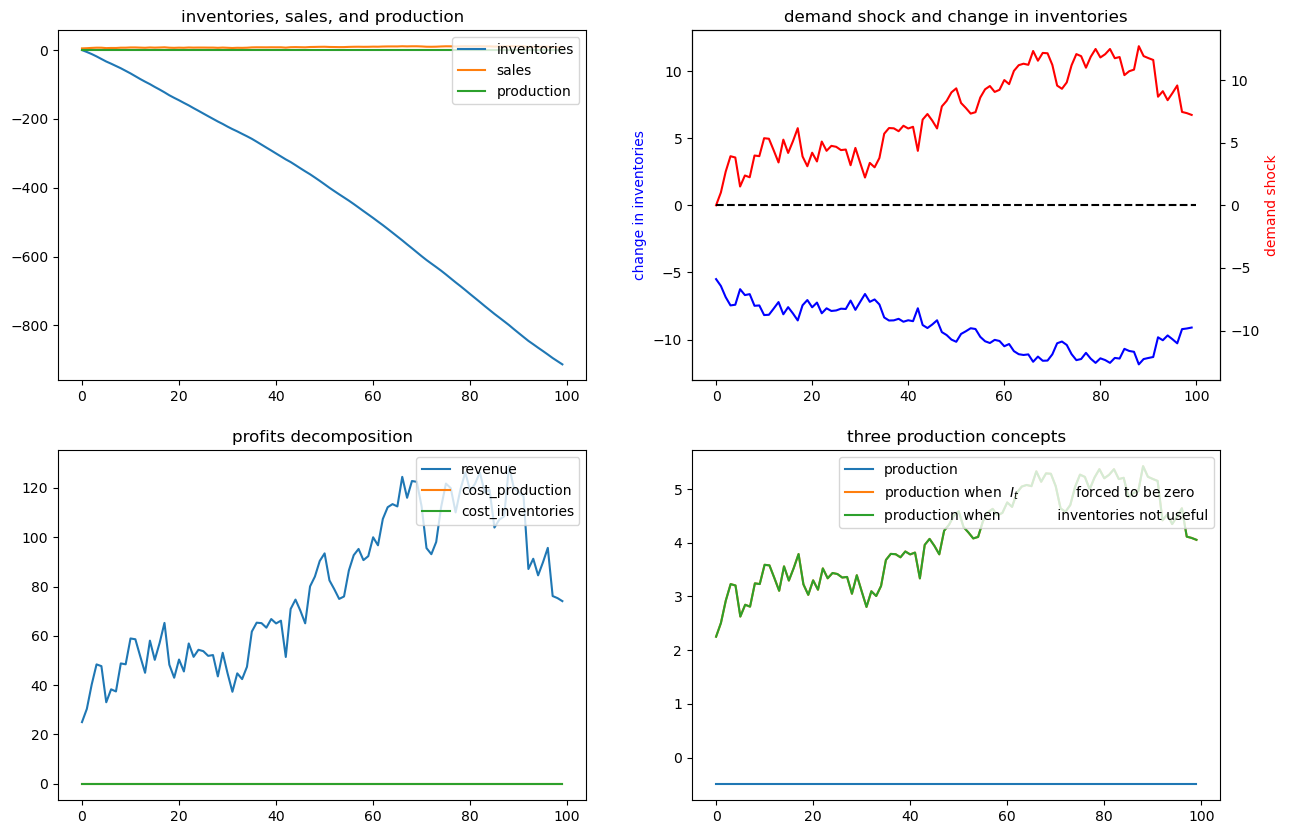

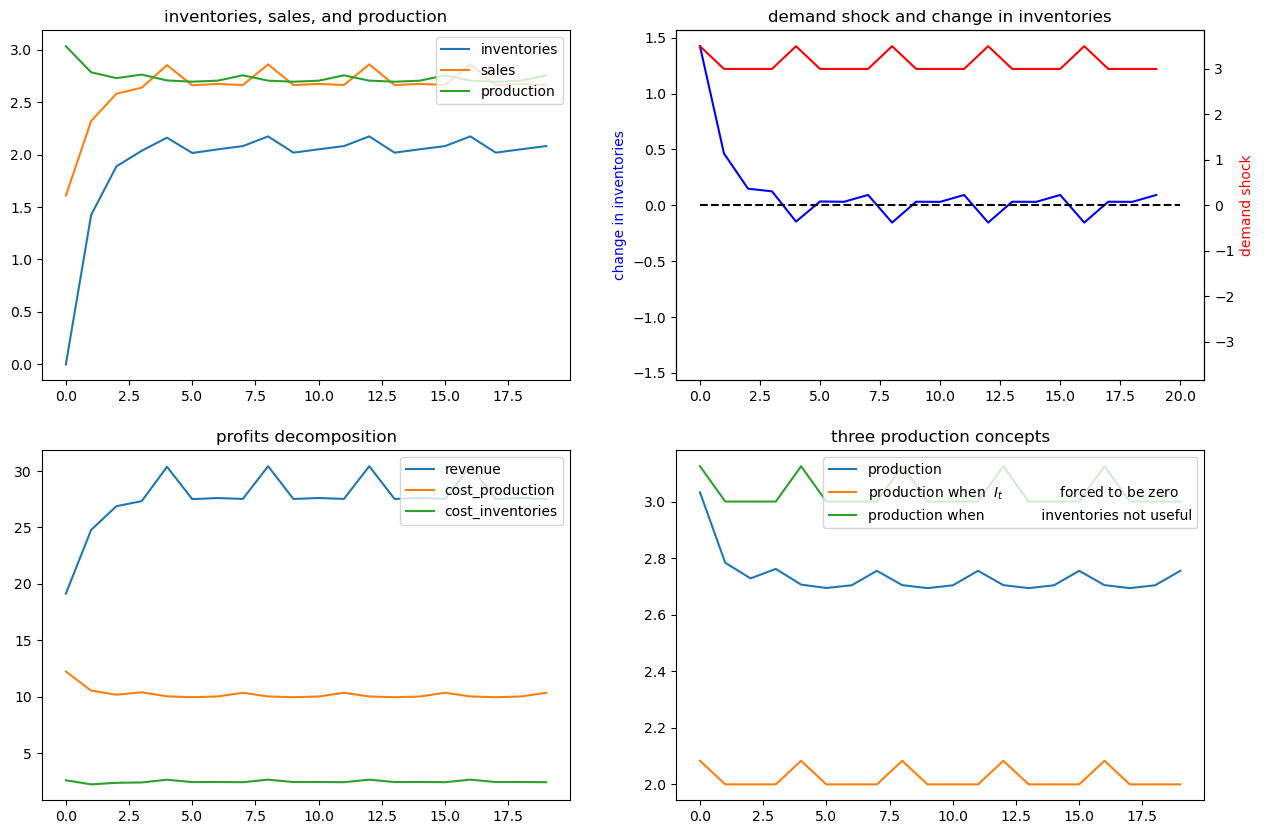

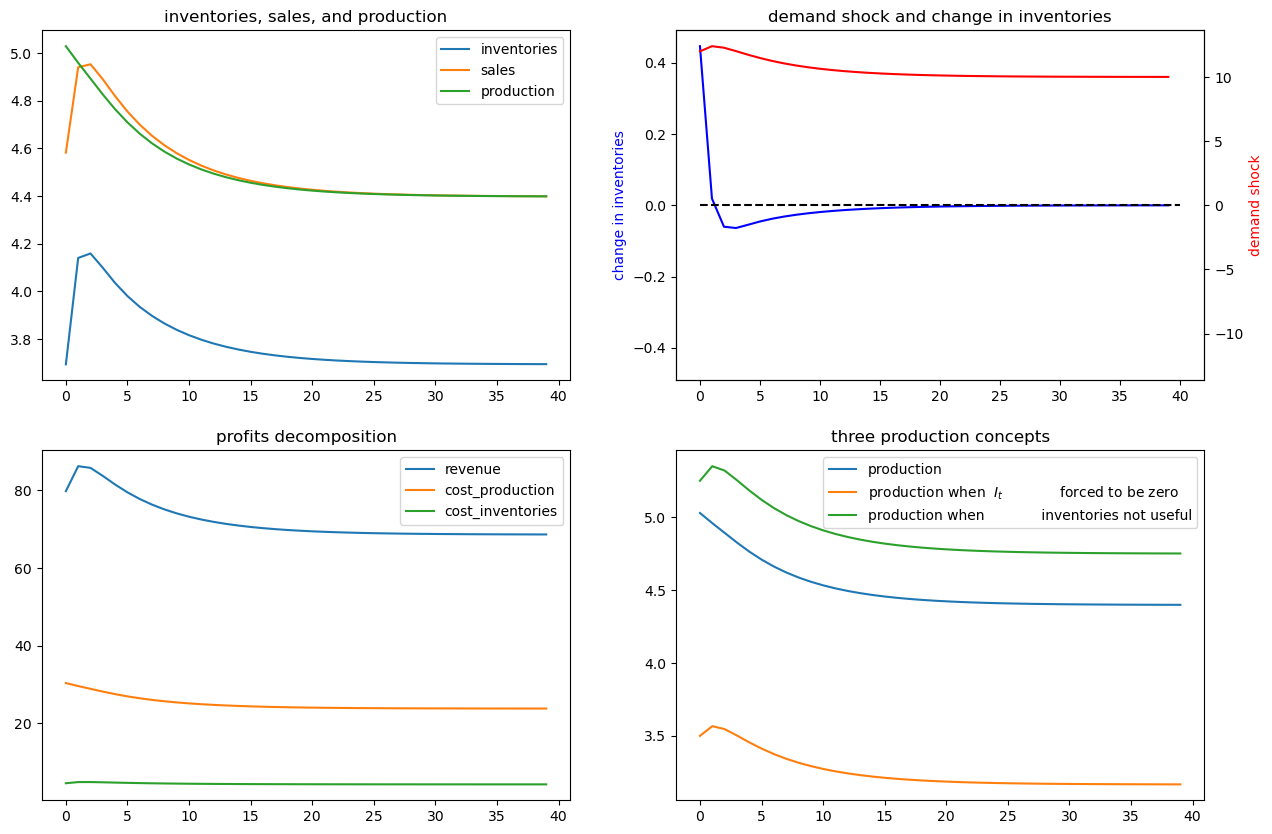

62.5. Example 2#

Next, we shut down randomness in demand and assume that the demand shock

Again, we’ll compute and display outcomes in some figures

ex2 = SmoothingExample(C2=[[0], [0]])

x0 = [0, 1, 0]

ex2.simulate(x0)

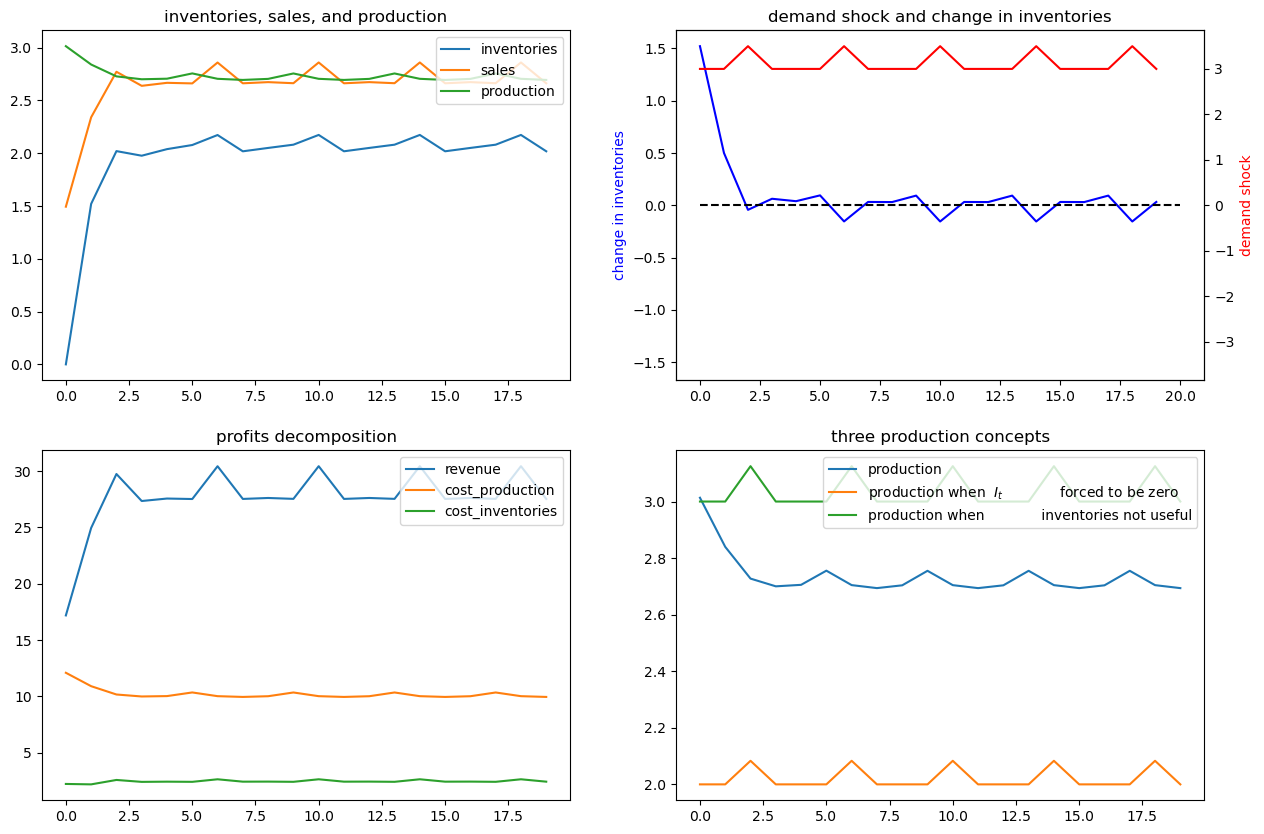

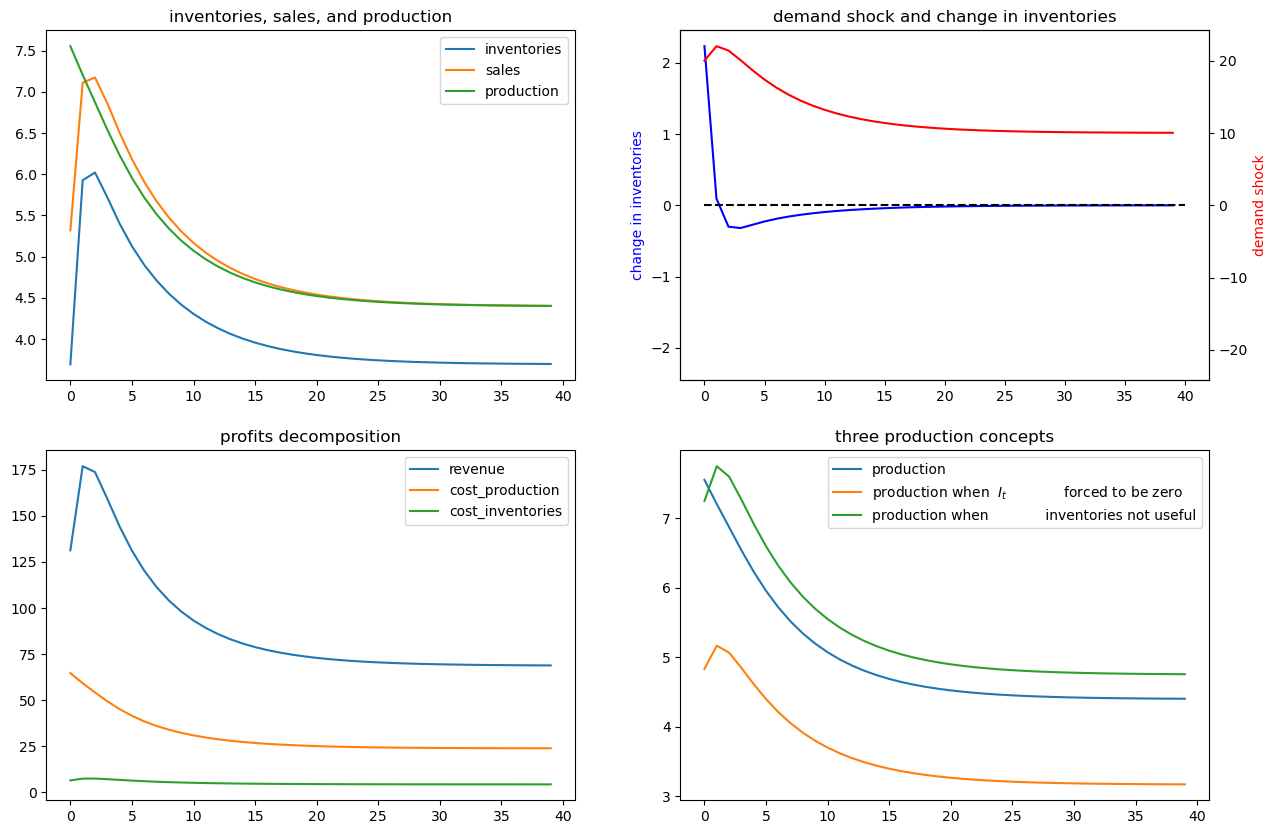

62.6. Example 3#

Now we’ll put randomness back into the demand shock process and also assume that there are zero costs of holding inventories.

In particular, we’ll look at a situation in which

Now it becomes optimal to set sales approximately equal to inventories and to use inventories to smooth production quite well, as the following figures confirm

ex3 = SmoothingExample(d1=0)

x0 = [0, 1, 0]

ex3.simulate(x0)

62.7. Example 4#

To bring out some features of the optimal policy that are related to some technical issues in linear control theory, we’ll now temporarily assume that it is costless to hold inventories.

When we completely shut down the cost of holding inventories by setting

(Technically, we have set parameters that end up violating conditions needed to assure stability of the optimally controlled state.)

The firm finds it optimal to set

Recall the law of motion for inventories

So when

for almost all values of

The dynamic program instructs the firm to set production costs to zero and to run a Ponzi scheme by running inventories down forever.

(We can interpret this as the firm somehow going short in or borrowing inventories)

The following figures confirm that inventories head south without limit

ex4 = SmoothingExample(d1=0, d2=0)

x0 = [0, 1, 0]

ex4.simulate(x0)

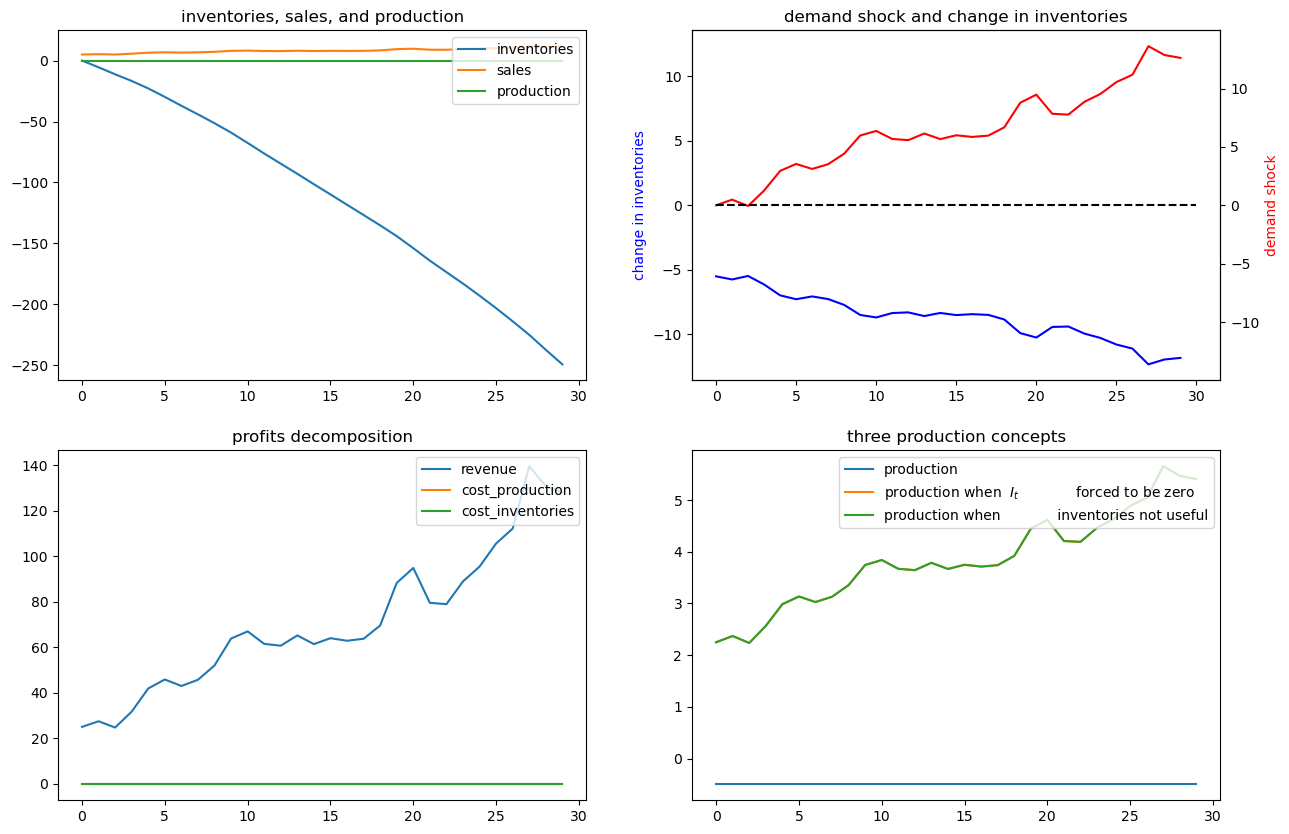

Let’s shorten the time span displayed in order to highlight what is going on.

We’ll set the horizon

# shorter period

ex4.simulate(x0, T=30)

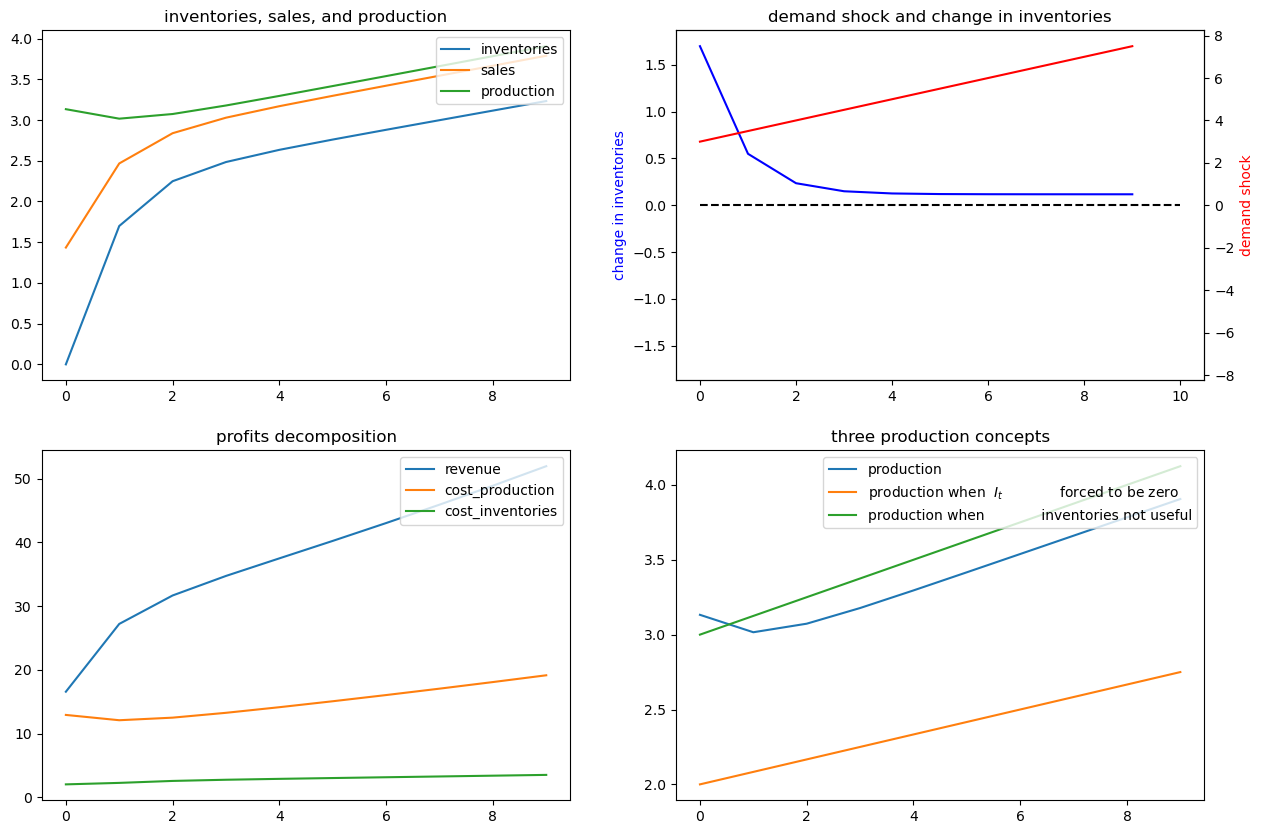

62.8. Example 5#

Now we’ll assume that the demand shock that follows a linear time trend

To represent this, we set

# Set parameters

a = 0.5

b = 3.

ex5 = SmoothingExample(A22=[[1, 0], [1, 1]], C2=[[0], [0]], G=[b, a])

x0 = [0, 1, 0] # set the initial inventory as 0

ex5.simulate(x0, T=10)

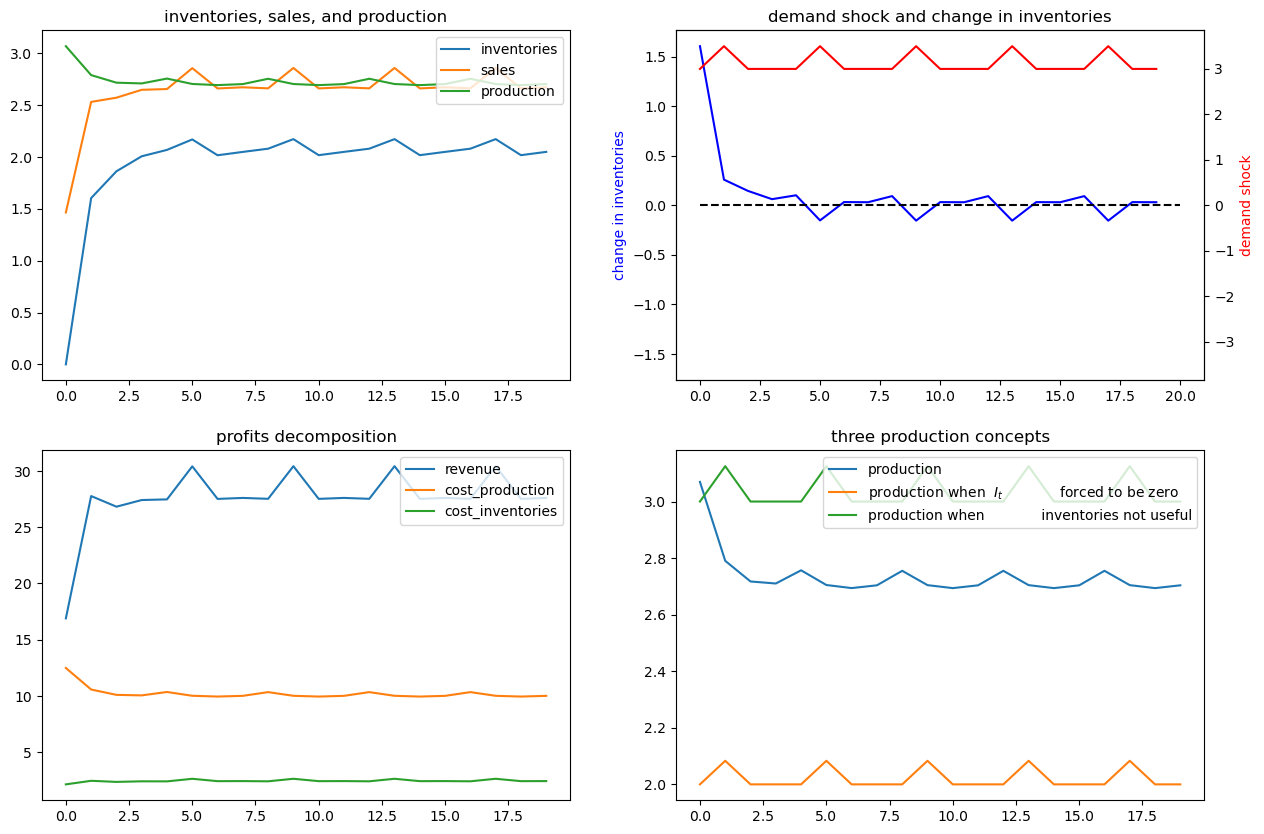

62.9. Example 6#

Now we’ll assume a deterministically seasonal demand shock.

To represent this we’ll set

where

ex6 = SmoothingExample(A22=[[1, 0, 0, 0, 0],

[0, 0, 0, 0, 1],

[0, 1, 0, 0, 0],

[0, 0, 1, 0, 0],

[0, 0, 0, 1, 0]],

C2=[[0], [0], [0], [0], [0]],

G=[b, a, 0, 0, 0])

x00 = [0, 1, 0, 1, 0, 0] # Set the initial inventory as 0

ex6.simulate(x00, T=20)

Now we’ll generate some more examples that differ simply from the initial season of the year in which we begin the demand shock

x01 = [0, 1, 1, 0, 0, 0]

ex6.simulate(x01, T=20)

x02 = [0, 1, 0, 0, 1, 0]

ex6.simulate(x02, T=20)

x03 = [0, 1, 0, 0, 0, 1]

ex6.simulate(x03, T=20)

62.10. Exercises#

Please try to analyze some inventory sales smoothing problems using the

SmoothingExample class.

Exercise 62.1

Assume that the demand shock follows AR(2) process below:

where SmoothingExample class. Simulate paths starting from the initial

condition

After this, try to construct a very similar SmoothingExample with

the same demand shock process but exclude the randomness

Solution to Exercise 62.1

# set parameters

α = 1

ρ1 = 1.2

ρ2 = -.3

# construct matrices

A22 =[[1, 0, 0],

[1, ρ1, ρ2],

[0, 1, 0]]

C2 = [[0], [1], [0]]

G = [0, 1, 0]

ex1 = SmoothingExample(A22=A22, C2=C2, G=G)

x0 = [0, 1, 0, 0] # initial condition

ex1.simulate(x0)

# now silence the noise

ex1_no_noise = SmoothingExample(A22=A22, C2=[[0], [0], [0]], G=G)

# initial condition

x0 = [0, 1, 0, 0]

# compute stationary states

x_bar = ex1_no_noise.LQ.compute_sequence(x0, ts_length=250)[0][:, -1]

x_bar

array([ 3.69387755, 1. , 10. , 10. ])

In the following, we add small and large shocks to

T = 40

# small shock

x_bar1 = x_bar.copy()

x_bar1[2] += 2

ex1_no_noise.simulate(x_bar1, T=T)

# large shock

x_bar1 = x_bar.copy()

x_bar1[2] += 10

ex1_no_noise.simulate(x_bar1, T=T)

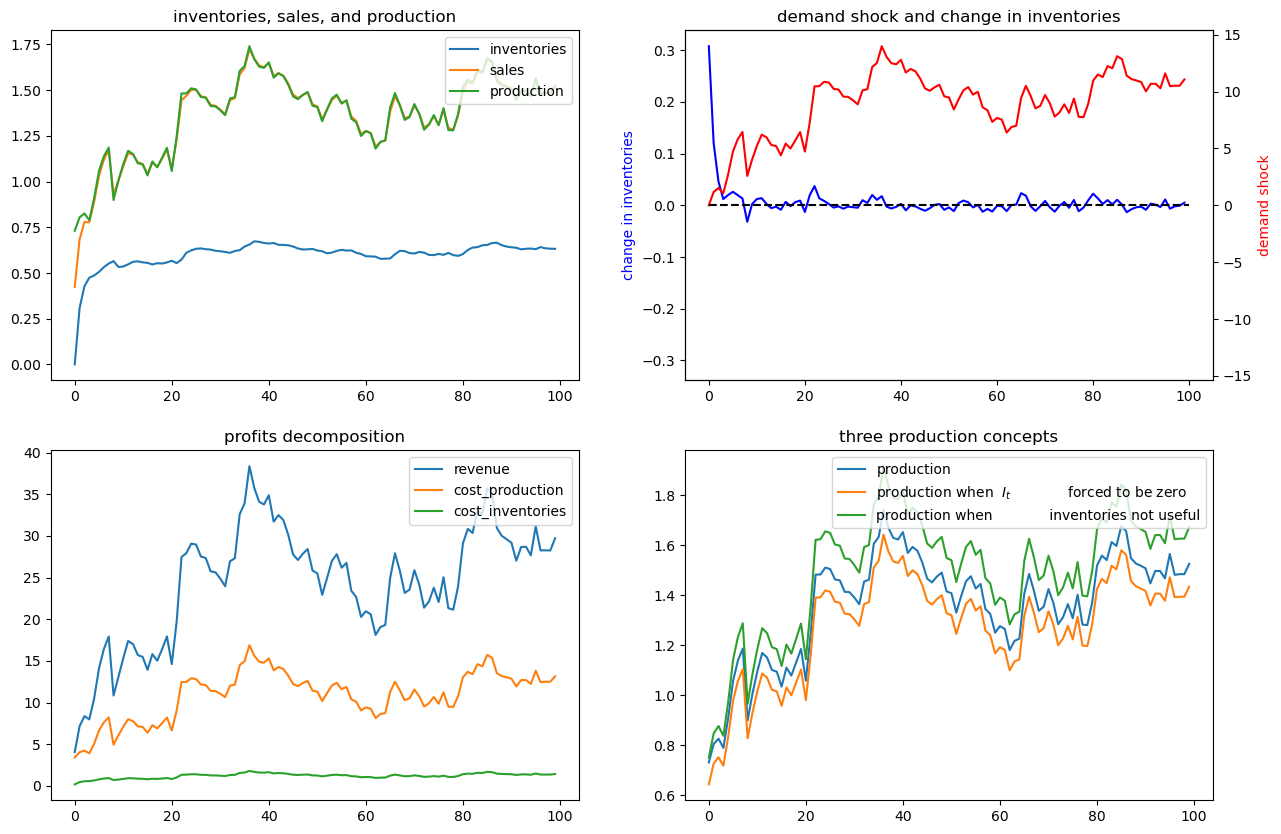

Exercise 62.2

Change parameters of

Make production more costly, by setting

Increase the cost of having inventories deviate from sales, by setting

Solution to Exercise 62.2

x0 = [0, 1, 0]

SmoothingExample(c2=5).simulate(x0)

SmoothingExample(d2=5).simulate(x0)