60. The Permanent Income Model#

Contents

60.1. Overview#

This lecture describes a rational expectations version of the famous permanent income model of Milton Friedman [Friedman, 1956].

Robert Hall cast Friedman’s model within a linear-quadratic setting [Hall, 1978].

Like Hall, we formulate an infinite-horizon linear-quadratic savings problem.

We use the model as a vehicle for illustrating

alternative formulations of the state of a dynamic system

the idea of cointegration

impulse response functions

the idea that changes in consumption are useful as predictors of movements in income

Background readings on the linear-quadratic-Gaussian permanent income model are Hall’s [Hall, 1978] and chapter 2 of [Ljungqvist and Sargent, 2018].

Let’s start with some imports

import matplotlib.pyplot as plt

plt.rcParams["figure.figsize"] = (11, 5) #set default figure size

import numpy as np

import random

from numba import jit

60.2. The Savings Problem#

In this section, we state and solve the savings and consumption problem faced by the consumer.

60.2.1. Preliminaries#

We use a class of stochastic processes called martingales.

A discrete-time martingale is a stochastic process (i.e., a sequence of random variables)

Here

The latter is just a collection of random variables that the modeler declares

to be visible at

When not explicitly defined, it is usually understood that

Martingales have the feature that the history of past outcomes provides no predictive power for changes between current and future outcomes.

For example, the current wealth of a gambler engaged in a “fair game” has this property.

One common class of martingales is the family of random walks.

A random walk is a stochastic process

for some IID zero mean innovation sequence

Evidently,

Not every martingale arises as a random walk (see, for example, Wald’s martingale).

60.2.2. The Decision Problem#

A consumer has preferences over consumption streams that are ordered by the utility functional

where

The consumer maximizes (60.1) by choosing a consumption, borrowing plan

Here

The consumer also faces initial conditions

60.2.3. Assumptions#

For the remainder of this lecture, we follow Friedman and Hall in assuming that

Regarding the endowment process, we assume it has the state-space representation

where

The spectral radius of

The restriction on

Regarding preferences, we assume the quadratic utility function

where

Note

Along with this quadratic utility specification, we allow consumption to be negative. However, by choosing parameters appropriately, we can make the probability that the model generates negative consumption paths over finite time horizons as low as desired.

Finally, we impose the no Ponzi scheme condition

This condition rules out an always-borrow scheme that would allow the consumer to enjoy bliss consumption forever.

60.2.4. First-Order Conditions#

First-order conditions for maximizing (60.1) subject to (60.2) are

These optimality conditions are also known as Euler equations.

If you’re not sure where they come from, you can find a proof sketch in the appendix.

With our quadratic preference specification, (60.5) has the striking implication that consumption follows a martingale:

(In fact, quadratic preferences are necessary for this conclusion 1.)

One way to interpret (60.6) is that consumption will change only when “new information” about permanent income is revealed.

These ideas will be clarified below.

60.2.5. The Optimal Decision Rule#

Now let’s deduce the optimal decision rule 2.

Note

One way to solve the consumer’s problem is to apply dynamic programming as in this lecture. We do this later. But first we use an alternative approach that is revealing and shows the work that dynamic programming does for us behind the scenes.

In doing so, we need to combine

the optimality condition (60.6)

the period-by-period budget constraint (60.2), and

the boundary condition (60.4)

To accomplish this, observe first that (60.4) implies

Using this restriction on the debt path and solving (60.2) forward yields

Take conditional expectations on both sides of (60.7) and use the martingale property of consumption and the law of iterated expectations to deduce

Expressed in terms of

where the last equality uses

These last two equations assert that consumption equals economic income

financial wealth equals

non-financial wealth equals

total wealth equals the sum of financial and non-financial wealth

a marginal propensity to consume out of total wealth equals the interest factor

economic income equals

a constant marginal propensity to consume times the sum of non-financial wealth and financial wealth

the amount the consumer can consume while leaving its wealth intact

60.2.5.1. Responding to the State#

The state vector confronting the consumer at

Here

Note that

It is plausible that current decisions

This is indeed the case.

In fact, from this discussion, we see that

Combining this with (60.9) gives

Using this equality to eliminate

To get from the second last to the last expression in this chain of equalities is not trivial.

A key is to use the fact that

We’ve now successfully written

60.2.5.2. A State-Space Representation#

We can summarize our dynamics in the form of a linear state-space system governing consumption, debt and income:

To write this more succinctly, let

and

Then we can express equation (60.11) as

We can use the following formulas from linear state space models to compute population mean

We can then compute the mean and covariance of

60.2.5.3. A Simple Example with IID Income#

To gain some preliminary intuition on the implications of (60.11), let’s look at a highly stylized example where income is just IID.

(Later examples will investigate more realistic income streams.)

In particular, let

Finally, let

Under these assumptions, we have

Further, if you work through the state space representation, you will see that

Thus, income is IID and debt and consumption are both Gaussian random walks.

Defining assets as

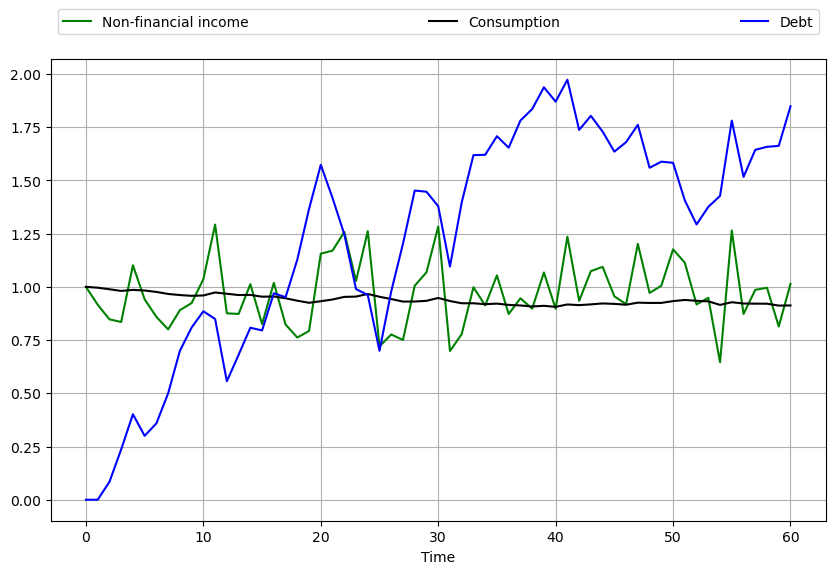

The next figure shows a typical realization with

r = 0.05

β = 1 / (1 + r)

σ = 0.15

μ = 1

T = 60

@jit

def time_path(T):

w = np.random.randn(T+1) # w_0, w_1, ..., w_T

w[0] = 0

b = np.zeros(T+1)

for t in range(1, T+1):

b[t] = w[1:t].sum()

b = -σ * b

c = μ + (1 - β) * (σ * w - b)

return w, b, c

w, b, c = time_path(T)

fig, ax = plt.subplots(figsize=(10, 6))

ax.plot(μ + σ * w, 'g-', label="Non-financial income")

ax.plot(c, 'k-', label="Consumption")

ax.plot( b, 'b-', label="Debt")

ax.legend(ncol=3, mode='expand', bbox_to_anchor=(0., 1.02, 1., .102))

ax.grid()

ax.set_xlabel('Time')

plt.show()

Observe that consumption is considerably smoother than income.

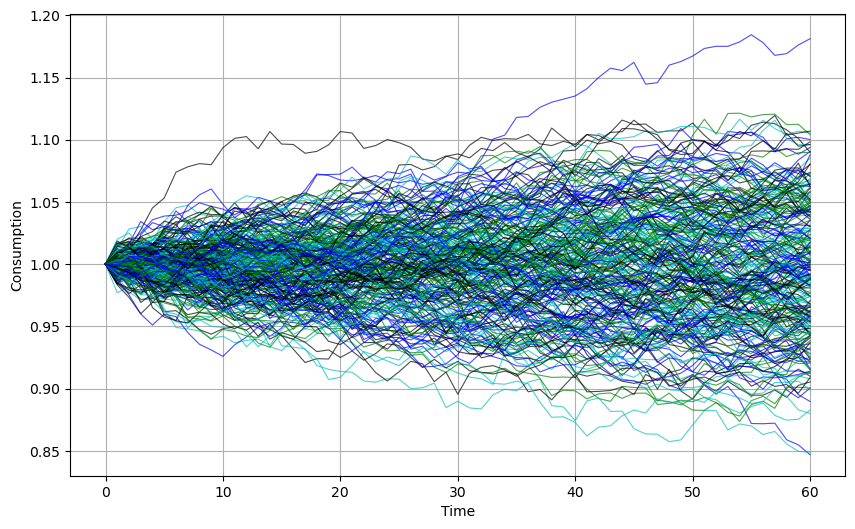

The figure below shows the consumption paths of 250 consumers with independent income streams

fig, ax = plt.subplots(figsize=(10, 6))

b_sum = np.zeros(T+1)

for i in range(250):

w, b, c = time_path(T) # Generate new time path

rcolor = random.choice(('c', 'g', 'b', 'k'))

ax.plot(c, color=rcolor, lw=0.8, alpha=0.7)

ax.grid()

ax.set(xlabel='Time', ylabel='Consumption')

plt.show()

60.3. Alternative Representations#

In this section, we shed more light on the evolution of savings, debt and consumption by representing their dynamics in several different ways.

60.3.1. Hall’s Representation#

Hall [Hall, 1978] suggested an insightful way to summarize the implications of LQ permanent income theory.

First, to represent the solution for

If we add and subtract

The right side is the time

We can represent the optimal decision rule for

Equation (60.17) asserts that the consumer’s debt due at

A high debt thus indicates a large expected present value of surpluses

Recalling again our discussion on forecasting geometric sums, we have

Using these formulas together with (60.3) and substituting into (60.16) and (60.17) gives the following representation for the consumer’s optimum decision rule:

Representation (60.18) makes clear that

The state can be taken as

The endogenous part is

Debt

Consumption is a random walk with innovation

This is a more explicit representation of the martingale result in (60.6).

60.3.2. Cointegration#

Representation (60.18) reveals that the joint process

Cointegration is a tool that allows us to apply powerful results from the theory of stationary stochastic processes to (certain transformations of) nonstationary models.

To apply cointegration in the present context, suppose that

Despite this, both

Nevertheless, there is a linear combination of

In particular, from the second equality in (60.18) we have

Hence the linear combination

Accordingly, Granger and Engle would call

When applied to the nonstationary vector process

Equation (60.19) can be rearranged to take the form

Equation (60.20) asserts that the cointegrating residual on the left side equals the conditional expectation of the geometric sum of future incomes on the right 4.

60.3.3. Cross-Sectional Implications#

Consider again (60.18), this time in light of our discussion of distribution dynamics in the lecture on linear systems.

The dynamics of

or

The unit root affecting

In particular, since

where

When

Let’s consider what this means for a cross-section of ex-ante identical consumers born at time

Let the distribution of

Equation (60.22) tells us that the variance of

A number of different studies have investigated this prediction and found some support for it (see, e.g., [Deaton and Paxson, 1994], [Storesletten et al., 2004]).

60.3.4. Impulse Response Functions#

Impulse response functions measure responses to various impulses (i.e., temporary shocks).

The impulse response function of

In particular, the response of

60.3.5. Moving Average Representation#

It’s useful to express the innovation to the expected present value of the endowment process in terms of a moving average representation for income

The endowment process defined by (60.3) has the moving average representation

where

Notice that

It follows that

Using (60.24) in (60.16) gives

The object

60.4. Two Classic Examples#

We illustrate some of the preceding ideas with two examples.

In both examples, the endowment follows the process

Here

60.4.1. Example 1#

Assume as before that the consumer observes the state

In view of (60.18) we have

Formula (60.26) shows how an increment

a permanent one-for-one increase in consumption and

no increase in savings

But the purely transitory component of income

The remaining fraction

Application of the formula for debt in (60.11) to this example shows that

This confirms that none of

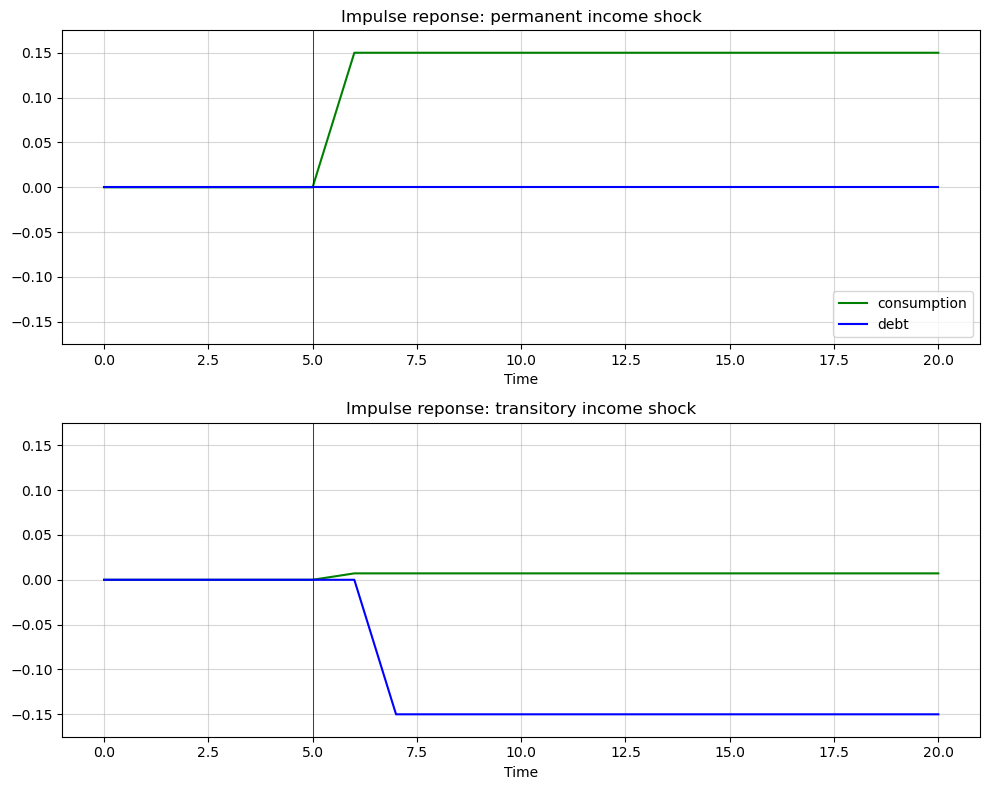

The next figure displays impulse-response functions that illustrates these very different reactions to transitory and permanent income shocks.

r = 0.05

β = 1 / (1 + r)

S = 5 # Impulse date

σ1 = σ2 = 0.15

@jit

def time_path(T, permanent=False):

"Time path of consumption and debt given shock sequence"

w1 = np.zeros(T+1)

w2 = np.zeros(T+1)

b = np.zeros(T+1)

c = np.zeros(T+1)

if permanent:

w1[S+1] = 1.0

else:

w2[S+1] = 1.0

for t in range(1, T):

b[t+1] = b[t] - σ2 * w2[t]

c[t+1] = c[t] + σ1 * w1[t+1] + (1 - β) * σ2 * w2[t+1]

return b, c

fig, axes = plt.subplots(2, 1, figsize=(10, 8))

titles = ['permanent', 'transitory']

L = 0.175

for ax, truefalse, title in zip(axes, (True, False), titles):

b, c = time_path(T=20, permanent=truefalse)

ax.set_title(f'Impulse reponse: {title} income shock')

ax.plot(c, 'g-', label="consumption")

ax.plot(b, 'b-', label="debt")

ax.plot((S, S), (-L, L), 'k-', lw=0.5)

ax.grid(alpha=0.5)

ax.set(xlabel=r'Time', ylim=(-L, L))

axes[0].legend(loc='lower right')

plt.tight_layout()

plt.show()

Notice how the permanent income shock provokes no change in assets

In contrast, notice how most of a transitory income shock is saved and only a small amount is saved.

The box-like impulse responses of consumption to both types of shock reflect the random walk property of the optimal consumption decision.

60.4.2. Example 2#

Assume now that at time

Under this assumption, it is appropriate to use an innovation representation to form

The discussion in sections 2.9.1 and 2.11.3 of [Ljungqvist and Sargent, 2018] shows that the pertinent state space representation for

where

In the same discussion in [Ljungqvist and Sargent, 2018] it is shown that

In other words,

Please see first look at the Kalman filter.

Applying formulas (60.18) implies

where the endowment process can now be represented in terms of the univariate innovation to

Equation (60.29) indicates that the consumer regards

fraction

fraction

The consumer permanently increases his consumption by the full amount of his estimate of the permanent part of

Therefore, in total, he permanently increments his consumption by a fraction

He saves the remaining fraction

According to equation (60.29), the first difference of income is a first-order moving average.

Equation (60.28) asserts that the first difference of consumption is IID.

Application of formula to this example shows that

This indicates how the fraction

60.5. Further Reading#

The model described above significantly changed how economists think about consumption.

While Hall’s model does a remarkably good job as a first approximation to consumption data, it’s widely believed that it doesn’t capture important aspects of some consumption/savings data.

For example, liquidity constraints and precautionary savings appear to be present sometimes.

Further discussion can be found in, e.g., [Hall and Mishkin, 1982], [Parker, 1999], [Deaton, 1991], [Carroll, 2001].

60.6. Appendix: The Euler Equation#

Where does the first-order condition (60.5) come from?

Here we’ll give a proof for the two-period case, which is representative of the general argument.

The finite horizon equivalent of the no-Ponzi condition is that the agent

cannot end her life in debt, so

From the budget constraint (60.2) we then have

Here

Substituting these constraints into our two-period objective

You will be able to verify that the first-order condition is

Using

The proof for the general case is similar.

- 1

A linear marginal utility is essential for deriving (60.6) from (60.5). Suppose instead that we had imposed the following more standard assumptions on the utility function:

- 2

An optimal decision rule is a map from the current state into current actions—in this case, consumption.

- 3

This would be the case if, for example, the spectral radius of

- 4

See [John Y. Campbell, 1988], [Lettau and Ludvigson, 2001], [Lettau and Ludvigson, 2004] for interesting applications of related ideas.

- 5

Representation (60.3) implies that

- 6

A moving average representation for a process